Bank of England Reduces Interest Rate to 3.75% Amid Economic Uncertainty

Introduction: A Welcome Relief for Borrowers

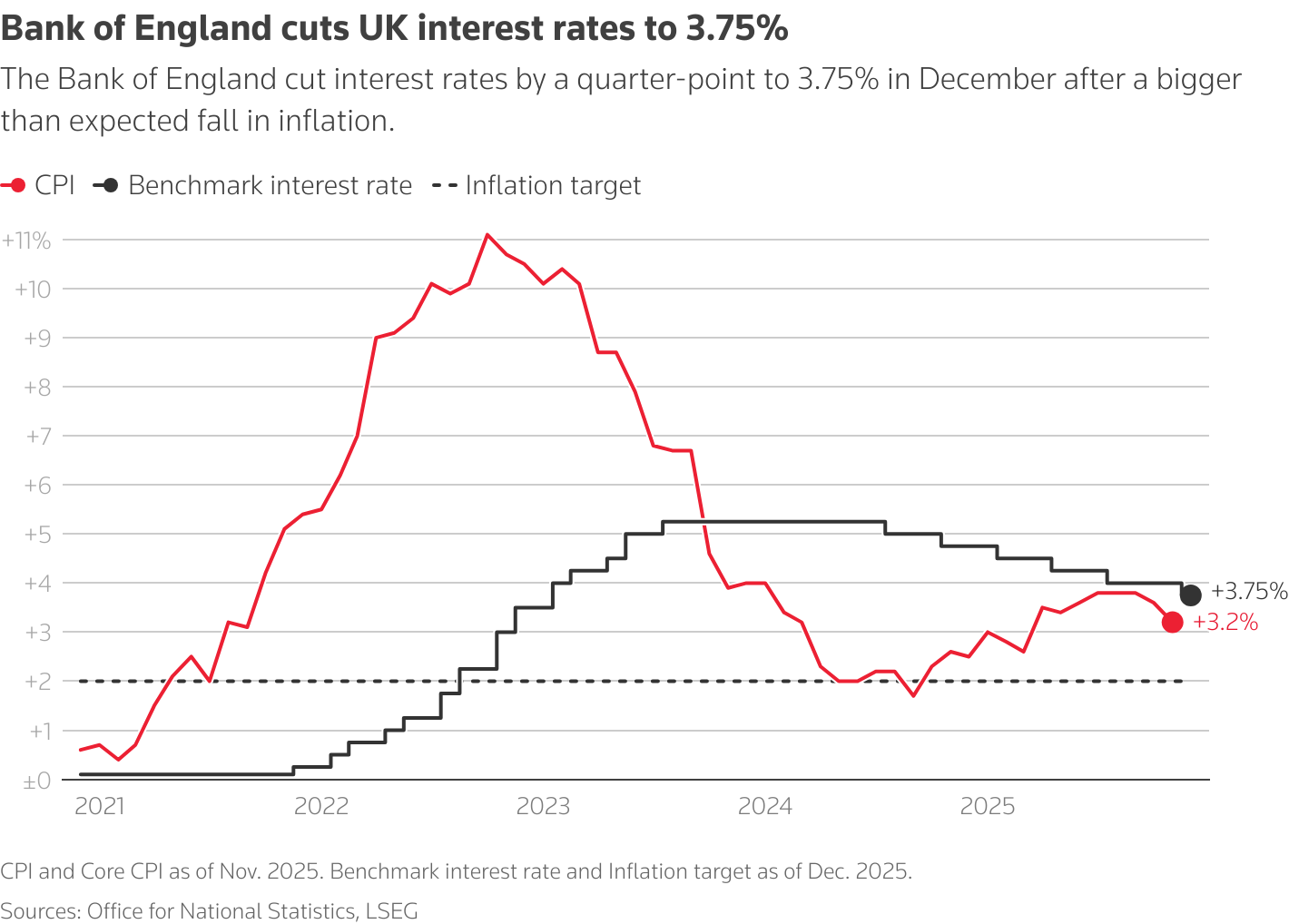

The Bank of England has delivered welcome news for consumers and businesses by cutting interest rates from 4% to 3.75% in its final monetary policy decision of 2025. The cut brings interest rates down to the lowest level since the beginning of February 2023, providing a much-needed boost ahead of the Christmas period. This decision reflects the central bank’s response to easing inflation and mounting signs of economic strain, though the path ahead remains uncertain.

Details Behind the Rate Cut Decision

This is the fourth cut of the year and was widely expected, yet the decision was far from unanimous. The decision to cut interest rates exposed divisions on the Monetary Policy Committee, with a narrow 5-4 vote in favour of lower borrowing costs, with Governor Andrew Bailey casting the deciding vote. The cut was influenced by encouraging economic data, including UK annual inflation slowing to 3.2% in November, the lowest reading in eight months and below the BoE’s forecast of 3.4%. Additionally, unemployment rose to a four-year high of 5.1% and private sector wage growth fell to its weakest pace since November 2020, signalling weakness in the labour market.

Economic Context and Challenges

The BOE said Thursday that it expected the economy to record no growth in the fourth quarter of 2025, underscoring the challenges facing the UK economy. BoE governor Andrew Bailey warned of a growing risk of a ‘sharper downturn’ in the UK labour market, highlighting concerns about rising unemployment and economic stagnation. Despite the rate cut, several MPC members remain cautious about underlying inflationary pressures, particularly concerning wage growth.

Outlook for 2026: Gradual Easing Expected

Looking ahead, economists diverge on how many more cuts might be made in 2026. JP Morgan’s current base case is for two more cuts in March and June, bringing the base rate down to 3.25%. However, the pace of future cuts remains uncertain. Barclays’ UK chief economist noted that whilst further reductions are likely, they may be limited. For savers, the outlook is less positive, with savings rates expected to trend downward throughout 2026, though competitive deals remain available in the market.

Conclusion: Significance for UK Consumers and Businesses

This rate cut provides immediate relief for borrowers, potentially leading to cheaper mortgage deals and reduced loan costs. However, the narrow vote split and cautious guidance from the Monetary Policy Committee suggest a more measured approach to monetary policy easing ahead. As the UK navigates persistent economic challenges including weak growth and labour market strain, the Bank of England faces a delicate balancing act between supporting economic activity and ensuring inflation returns sustainably to its 2% target. Consumers and businesses should prepare for a gradual easing cycle rather than aggressive rate cuts in the coming year.