Barclays Slashes Mortgage Rates as Competition Heats Up in 2026

Major Mortgage Rate Reductions Signal Growing Competition

Barclays has announced significant mortgage rate cuts taking effect from 9 January, covering purchase and remortgage deals. This move positions the bank alongside other major lenders in what’s becoming an increasingly competitive mortgage market for 2026.

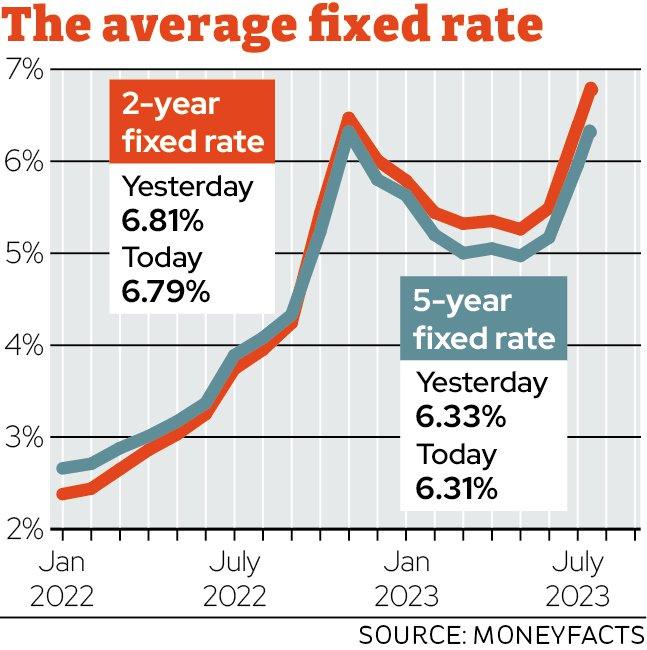

Mortgage costs have now fallen to their lowest point since 2022, offering welcome relief to prospective homebuyers and those looking to remortgage. The two-year Premier product with an £899 fee at 60% loan to value will fall from 3.62% to 3.56%, whilst corresponding products at 75% LTV will be cut from 3.69% to 3.6%.

What’s Driving the Rate Cuts?

The recent reductions follow a broader pattern among high street banks responding to market conditions. Mortgage rates are falling rapidly following last month’s Bank of England base rate cut from 4% to 3.75%, the sixth reduction since August 2024. HSBC kicked off the reductions on Monday, becoming the first major bank to lower mortgage costs in 2026, with Halifax following shortly after.

Barclays has reduced rates on selected two- and five-year fixes across its existing customer reward range at 60% and 75% LTV. The changes also extend to Green Home products and higher loan-to-value offerings, demonstrating the breadth of Barclays’ competitive response.

Market Implications and Future Outlook

Industry experts view these developments positively for borrowers. The price cuts early in the year are considered good news for borrowers, especially those keen to get on the property ladder or remortgage. Further cuts to the base rate are anticipated during 2026, which could lead to additional mortgage rate reductions throughout the year.

Santander currently holds the market’s most competitive offering, with a two-year fixed deal at 3.55 per cent with £749 fee at 60 per cent loan-to-value. This heightened competition among lenders means borrowers have more options than they’ve had in recent years, though individual rates will vary based on deposit size, loan type, and personal circumstances.