Current Overview of EasyJet Share Price

Introduction

The share price of EasyJet, one of Europe’s leading low-cost carriers, plays a vital role in the airline industry’s financial landscape. Stock performance not only reflects the company’s operational success but also broader economic conditions, consumer travel behaviour, and geopolitical influences. With travel returning to pre-pandemic levels, investors are keenly watching the EasyJet share price for signals of recovery and growth potential.

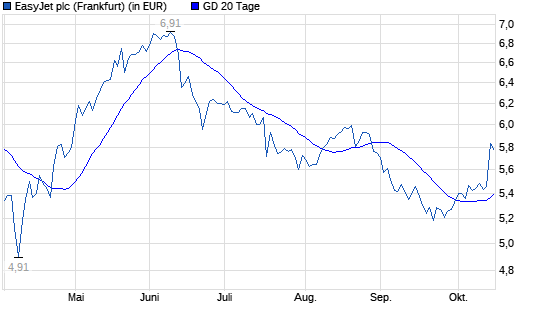

Current Share Price Trends

As of October 2023, EasyJet’s share price has shown significant fluctuations due to varying factors impacting the travel sector. Recently, the shares were traded at approximately £4.50, representing a modest increase of 5% over the past month. This uptick has primarily been attributed to a surge in summer travel demand, alongside positive earnings forecasts for the upcoming quarter.

Market Influences

A few key factors are currently affecting EasyJet’s share price:

- Recovery of the Travel Sector: Analysts note that the ongoing recovery following the COVID-19 pandemic is a boon for airlines, including EasyJet. Strong passenger numbers and improved load factors have lifted investor sentiment.

- Fuel Costs: Fluctuating oil prices remain a significant factor impacting profitability. A decrease in fuel prices could lead to higher margins for EasyJet, thereby supporting share prices.

- Regulatory Changes: Any changes in government regulations regarding travel safety and airline operations can have immediate effects on stock performance.

- Inflation and Economic Indicators: The UK’s inflation rate and economic stability are crucial for EasyJet’s pricing strategies and overall profitability. Economic instability can lead to reduced consumer spending on travel services.

Conclusion

The EasyJet share price is a crucial indicator for investors looking to understand the airline’s market position and future outlook. While there are encouraging signs of recovery in the travel sector, challenges such as fluctuating fuel costs and economic uncertainties remain prominent. Stakeholders should continue to monitor not only EasyJet’s share price but also ongoing global trends and economic indicators to make informed investment decisions. As travel demand stabilises and expands, EasyJet may harness this potential for sustained growth, impacting its share price positively in the long run.