Current Trends and Analysis of GSK Share Price

Introduction

The share price of GlaxoSmithKline (GSK), a major global pharmaceutical company, has garnered significant attention from investors and analysts alike. Understanding the fluctuations in GSK’s share price is crucial, as it reflects the company’s performance, market conditions, and broader economic factors. With ongoing developments in the pharmaceutical industry and recent earnings reports, the relevance of GSK’s share price has become even more pronounced.

Current Market Overview

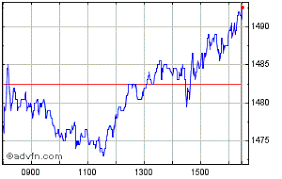

As of October 2023, GSK’s share price is currently trading at around £15.50. This marks a modest increase from earlier in the year, where shares were valued approximately at £14.00. Several factors have contributed to this positive shift, including promising results from clinical trials, increased revenue projections for their vaccines, and the overall recovery of the pharmaceutical sector post-pandemic.

Factors Influencing GSK Share Price

1. **Clinical Trials and Approvals**: One of the primary drivers for GSK’s recent surge has been the successful results from various clinical trials, particularly related to their vaccination programs. The company announced significant advancements in its respiratory vaccine, which have the potential to capture a notable market share.

2. **Quarterly Earnings Reports**: GSK’s latest earnings report showed a year-over-year revenue increase of 10%, primarily due to robust sales of their shingles vaccine. Investors responded positively to the company’s outlook, which provided a strong forward guidance for the next quarters.

3. **Market Trends**: The global focus on healthcare innovations and drug development has led to increased investment in pharmaceutical companies. The overall market sentiment towards health stocks has remained optimistic, benefiting GSK in the trading arena.

Conclusion

In conclusion, the current trajectory of GSK’s share price reflects a blend of corporate growth and positive market sentiment. The recent advances in product development, coupled with encouraging financial performance, suggest that the stock may continue to attract investor interest in the near future. Analysts are optimistic, with forecasts suggesting a potential rise to £17.00 by the end of 2024, provided that current trends continue and GSK maintains its positive momentum in drug and vaccine development.

For investors considering GSK as part of their portfolio, staying informed about upcoming product launches and market adjustments will be vital.