Current Trends in Barclays Share Price

Introduction

The Barclays share price is a significant metric for investors, analysts, and those interested in the financial services sector. As one of the leading banks in the UK, Barclays plays a pivotal role in the economy, and fluctuations in its share price can indicate broader market trends and investor sentiment towards the banking industry.

Current Share Price Overview

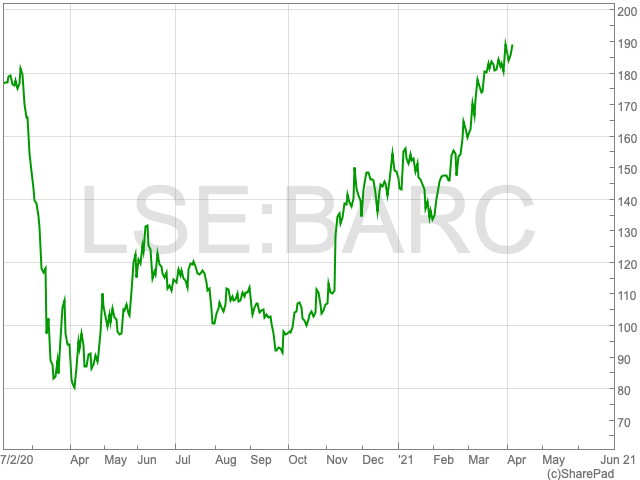

As of late October 2023, Barclays’ shares have experienced notable volatility. The current share price is hovering around £1.50, showing a slight decrease of approximately 2% over the past week. Analysts attribute this decline to a combination of global market uncertainty, ongoing inflation concerns, and challenges faced by the banking sector as interest rates stabilise.

Factors Influencing the Share Price

Several factors have influenced the recent movements in Barclays’ share price:

- Economic Conditions: With the Bank of England maintaining a cautious approach to interest rate adjustments, market participants remain wary. A slowing economy could lead to decreased lending and profitability for banks like Barclays.

- Regulatory Changes: Recent announcements regarding tighter regulations in the banking sector have also created apprehensions. Investors are concerned about how these regulations may impact Barclays’ operational costs and profit margins.

- Market Competition: With new fintech companies continuously entering the market, traditional banking institutions face increased pressure on fees and services, impacting their competitive edge.

Outlook for Barclays Shares

Financial analysts offer mixed predictions for the Barclays share price moving forward. Some experts suggest that with potential stabilisation of the economy in early 2024, there could be a recovery in share value if Barclays continues to adapt effectively to the changing regulatory landscape. Others advise caution, noting that renewed volatility in global markets could adversely affect investor confidence.

Conclusion

The Barclays share price remains a critical indicator of not only the bank’s health but also a barometer of the financial industry’s overall sentiment. For current and potential investors, closely monitoring the key influencing factors is essential for making informed decisions. As always, thorough research and consideration of personal investment strategies are advisable before engaging in stock trading. The future of Barclays shares will depend on both external economic factors and how well the bank manages its strategic responses to these challenges.