Current Trends in FTSE 100 Share Prices

Introduction

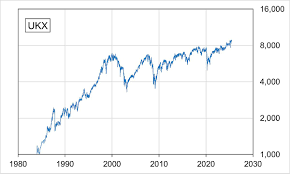

The FTSE 100, a stock market index that measures the performance of the 100 largest companies listed on the London Stock Exchange, plays a crucial role in the UK economy. With its latest fluctuations and trends, the share price of the FTSE 100 provides valuable insights for investors and analysts alike, reflecting both domestic and global economic conditions.

Recent Performance

As of late October 2023, the FTSE 100 has shown notable variability, hovering around the 7,400 points mark. This represents a recovery from earlier declines amid ongoing economic uncertainties, including inflation and geopolitical tensions. Notably, companies such as Unilever and BP have made significant contributions to the recent uptick, aligning with global market trends.

The index experienced a surge following the announcement of better-than-expected UK GDP growth figures, which indicated resilience in the face of rising living costs. Analysts reported that consumer spending had remained steady, providing a buffer for several large firms listed on the FTSE 100. Furthermore, the easing supply chain issues in recent months have positively impacted sectors like manufacturing and retail.

Impact Factors

Various factors are currently influencing share prices within the FTSE 100. One major contributor is the interest rate policy of the Bank of England, which aims to combat inflation but may also restrain economic growth. Additionally, global energy prices and the recovery of the travel sector continue to be crucial determinants of investor sentiment. The performance of the pound sterling against other currencies also plays a significant role, as a weaker pound can enhance export competitiveness for UK-based firms.

Conclusion

In summary, the FTSE 100 share price remains a vital indicator of the UK’s economic health and investor confidence. Current trends suggest a cautious optimism among investors, with a focus on key economic data releases and global developments that may influence market behaviour. As analysts predict further fluctuations in the coming months, it is essential for investors to stay informed and adapt their strategies accordingly. The landscape remains dynamic, suggesting that the future of the FTSE 100 will continue to reflect both domestic resilience and international pressures.