Current Trends in Google’s Share Price

Introduction

The dynamics of Google’s share price have a significant impact not only on the company but also on the larger tech industry and global markets. As one of the leading technology firms globally, Alphabet Inc., the parent company of Google, plays a pivotal role in shaping market sentiments. Understanding the share price fluctuations of Google is crucial for investors, analysts, and economic observers alike.

Recent Developments

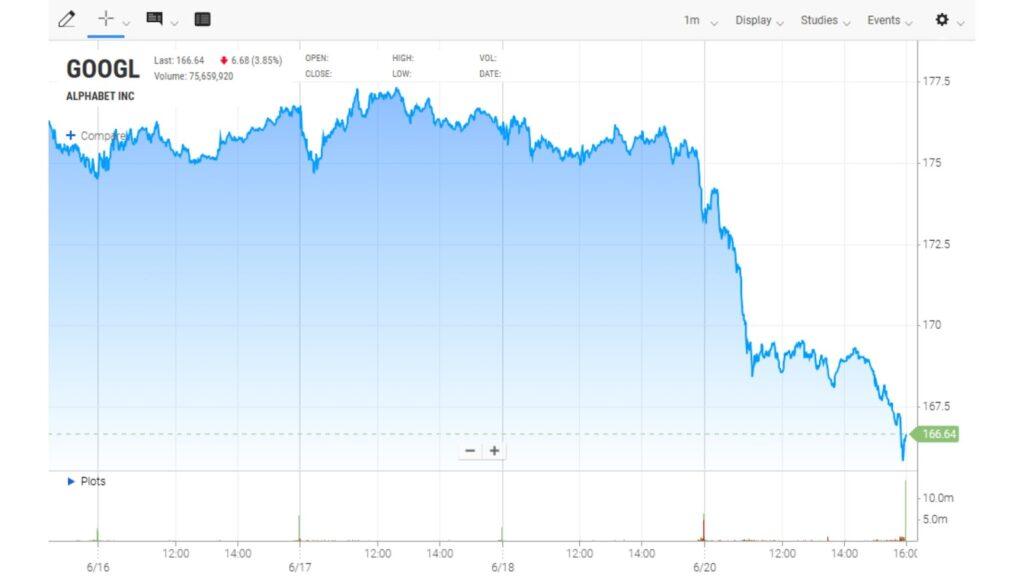

As of October 2023, Google’s share price has shown considerable stability amid a fluctuating tech market. Currently trading at approximately £2,370 per share, Alphabet’s stock reflects a robust performance, particularly given the company’s consistent revenue growth from its advertising and cloud services sectors.

On September 30, 2023, Google reported its quarterly earnings, revealing an increase in revenue of 12% compared to the previous year. This positive financial performance was attributed to an upsurge in digital advertising spending and a strong demand for cloud computing services. Analysts had expected a rebound in Google’s earnings following a previous slowdown due to economic uncertainties, and the results did not disappoint, which helped bolster investor confidence and increase share prices.

Market Reactions

The market reacted positively to Google’s earnings report, with prices surging by 5% in the following trading sessions. Analysts from major investment firms have upgraded their ratings on Google stocks, reflecting optimism about continued growth in both the advertising and cloud sectors. Despite a recent downturn in technology stocks due to broader market pressures, Google’s established position has positioned it as a safer investment compared to its competitors.

Additionally, Google is currently focusing on expanding its artificial intelligence (AI) capabilities, a move that analysts believe could drive significant growth and innovation in the coming years. The company’s investment in AI technologies not only promises to enhance its existing products but also positions it as a leader in the burgeoning tech landscape.

Conclusion

In conclusion, Google’s share price remains a vital indicator of the technology sector’s health amid ongoing economic shifts. With solid quarterly earnings, a robust growth strategy, and a focus on AI, Alphabet Inc. is poised for continued success. Investors should closely monitor these developments, as the trajectory of Google’s share price could have profound implications, both for the company’s future and for the technology market as a whole. As we move into 2024, analysts predict that the company will continue to thrive, barring any unforeseen economic disruptions.