Current Trends in Rolls Royce Share Price

Introduction

The Rolls Royce share price has been a focal point for investors in the aerospace and defence sectors. Understanding the movements of this iconic brand’s shares not only reflects the company’s performance but also indicates broader trends in the economy, especially in the manufacturing and travel industries. Recent developments surrounding the company’s recovery plans from the pandemic and strategic initiatives make it imperative for investors to stay updated.

Recent Performance

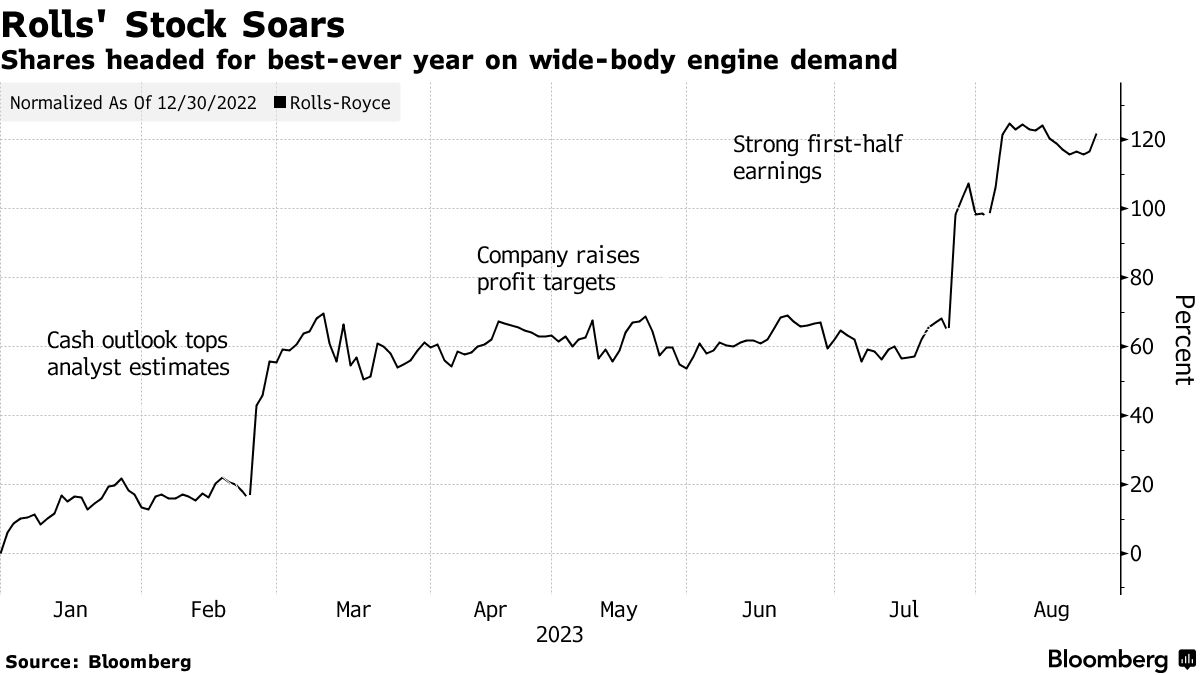

As of mid-October 2023, the Rolls Royce share price has shown significant volatility, influenced by various factors including global travel demand, supply chain issues, and fluctuations in energy prices. After experiencing a major downturn during the COVID-19 pandemic, the shares have rebounded as air travel restrictions eased, and airlines began to resume operations.

Currently, the share price stands at approximately £1.75, a notable increase from earlier this year when it hovered around £1.20. This recovery can be attributed to several key developments: increased orders for engines from major airlines, a successful restructuring plan, and a focus on sustainable aviation technologies.

Market Influences

Analysts point to a mix of market dynamics affecting the Rolls Royce share price. The revival of international travel has spurred demand for aircraft maintenance and new engine orders, directly impacting the company’s bottom line. Moreover, the ongoing geopolitical tensions and rising energy costs have led to speculations affecting stock valuations across the aerospace sector.

Recent earnings reports have shown that Rolls Royce is on track to achieve its pre-pandemic operational levels by mid-2024, further cementing investor confidence. The company’s ongoing investments in green technologies and partnerships aimed at reducing carbon emissions are also expected to bolster its market position and share price in the long run.

Conclusion

The recent fluctuations in the Rolls Royce share price highlight a critical juncture for the company as it navigates the post-pandemic landscape. For investors, staying informed about market conditions, industry developments, and the company’s strategic moves will be essential in making informed decisions. As the recovery of the airline industry continues to unfold, Rolls Royce’s efforts towards innovation and sustainability could lead to a positive influence on its share price moving forward. Observers predict that should these trends continue, investors might see a significant appreciation in the stock value in the next fiscal year.