Current Trends in Tesla Share Price: October 2023 Insights

Introduction

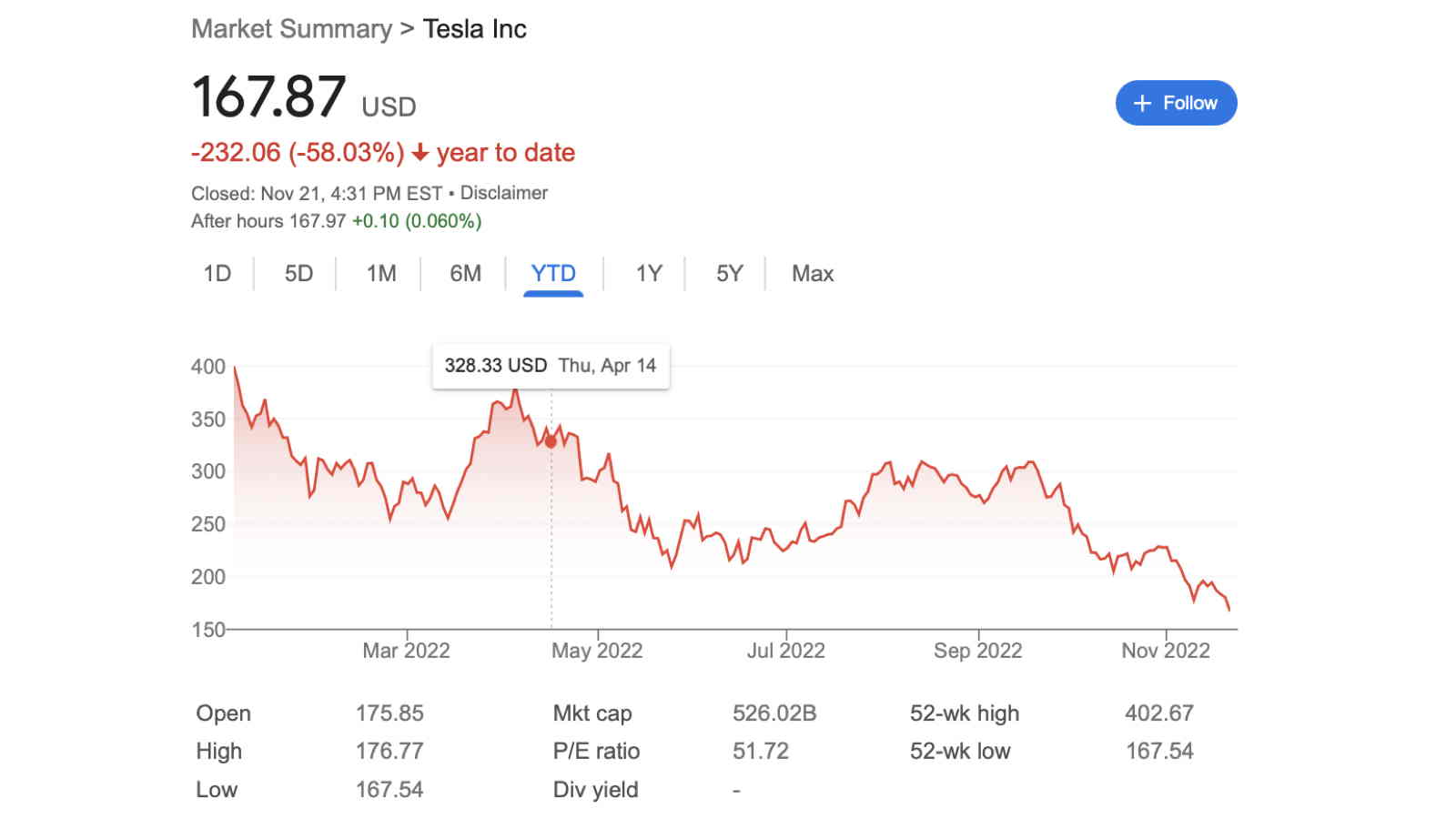

The share price of Tesla, Inc. has been a subject of intense scrutiny and interest among investors and market analysts alike. As one of the leading electric vehicle manufacturers globally, Tesla’s stock performance is often seen as an indicator of the health of the green tech sector. For October 2023, various factors are impacting Tesla’s share price, which remains crucial for both short-term traders and long-term investors.

Recent Developments Affecting Tesla’s Share Price

As of mid-October 2023, Tesla’s share price has experienced fluctuations due to several converging factors. One primary catalyst for the changes has been the announcement of its Q3 financial results, which showed a significant year-on-year increase in vehicle deliveries. The company reported a 35% increase in deliveries compared to Q3 2022, reaching 450,000 vehicles. This performance surpassed analysts’ expectations and initially provided a boost to the share price.

However, external factors such as rising raw material costs and increasing competition in the EV market have led to volatility. Companies like Rivian and Lucid Motors continue to expand their presence, prompting concerns about Tesla’s market share. Furthermore, market sentiment has been influenced by macroeconomic conditions, including inflation rates and interest rate hikes in the US, impacting overall investor confidence.

Investor Sentiments and Projections

Investor sentiment surrounding Tesla has been cautiously optimistic. Many analysts are projecting a positive outlook based on the company’s innovative advancements in battery technology and potential entry into new markets. Recent advancements in AI-driven manufacturing processes have also led to speculation that Tesla could achieve higher efficiencies, thereby improving margins.

Furthermore, the anticipated rollout of the Cybertruck later this year could serve as a significant driver for future sales and, consequently, share price appreciation. Positive developments in autopilot technology and full self-driving capabilities remain central to Tesla’s long-term growth strategy, which investors are keenly watching.

Conclusion

In conclusion, while Tesla’s share price faces challenges primarily from rising competition and broader economic pressures, its recent delivery report and upcoming product launches indicate potential for growth. Investors should remain vigilant, monitoring both Tesla’s strategic moves and wider market trends. As Tesla adapts to the changing landscape of the EV market, its share price will continue to be closely tied to both its operational performance and the external economic environment.