Exploring the Benefits of Child Trust Funds

Introduction

The Child Trust Fund (CTF) is a significant savings initiative introduced by the UK government designed to encourage long-term saving for children’s future. Launched in 2005, the scheme aimed to provide every child born in the UK with a financial head start, helping families to save and invest for their child’s future needs. With the recent discussions surrounding financial literacy and savings in the UK, understanding the importance of CTF remains highly relevant, particularly as many parents seek ways to secure their children’s financial independence.

What is a Child Trust Fund?

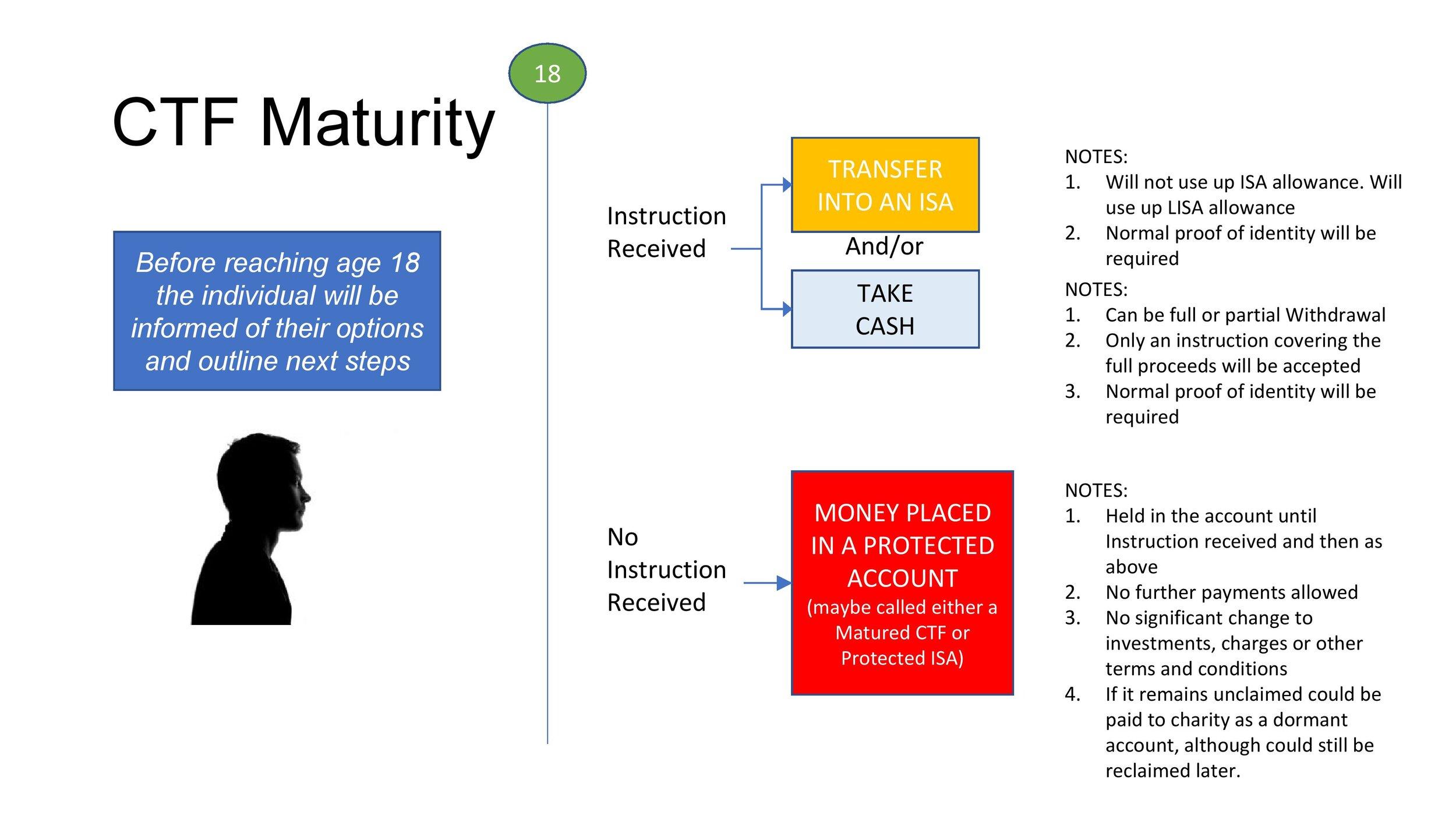

A Child Trust Fund is a tax-free savings or investment account set up for children born between September 1, 2002, and January 2, 2011. The government initially provided a voucher to parents, which could be used to open a CTF account. There are two types of accounts: cash CTFs, which are similar to a traditional savings account, and share CTFs, which invest the money in the stock market. The account matures when the child turns 18, allowing them to access the funds to help with education, starting a business, or other significant life events.

Recent Changes and Current Status

In recent years, the discussion around Child Trust Funds has gained traction due to the potential changes in government policy and new financial education initiatives. The government has been considering measures to help families make the most of their Child Trust Funds, including widening access and ensuring that all families are aware of these financial opportunities. As of 2023, approximately 6.4 million children have CTF accounts, with a combined value of over £9 billion. This figure underscores the potential benefits of these funds for future generations.

Importance of Financial Education

In light of the growing financial literacy campaigns across the UK, aligning CTF knowledge with educational initiatives becomes imperative. Understanding the long-term benefits of saving and investing through a Child Trust Fund can empower both parents and children alike. By fostering an environment where children see the importance of savings from a young age, the CTF serves not just as a financial tool, but as a vehicle for imparting essential life skills.

Conclusion

The Child Trust Fund represents a critical opportunity for parents to secure their child’s future and cultivate a culture of financial awareness and responsibility. As the government evaluates potential updates and strategies surrounding CTFs, it is vital for families to stay informed about the benefits these accounts offer. With the right approach, Child Trust Funds can not only provide a financial foundation for children but also promote a landscape where financial literacy thrives, enabling future generations to navigate their economic landscape with confidence.