Federal Reserve Cuts Interest Rates for Third Consecutive Time in December 2025

Historic Rate Decision Signals Cautious Monetary Policy

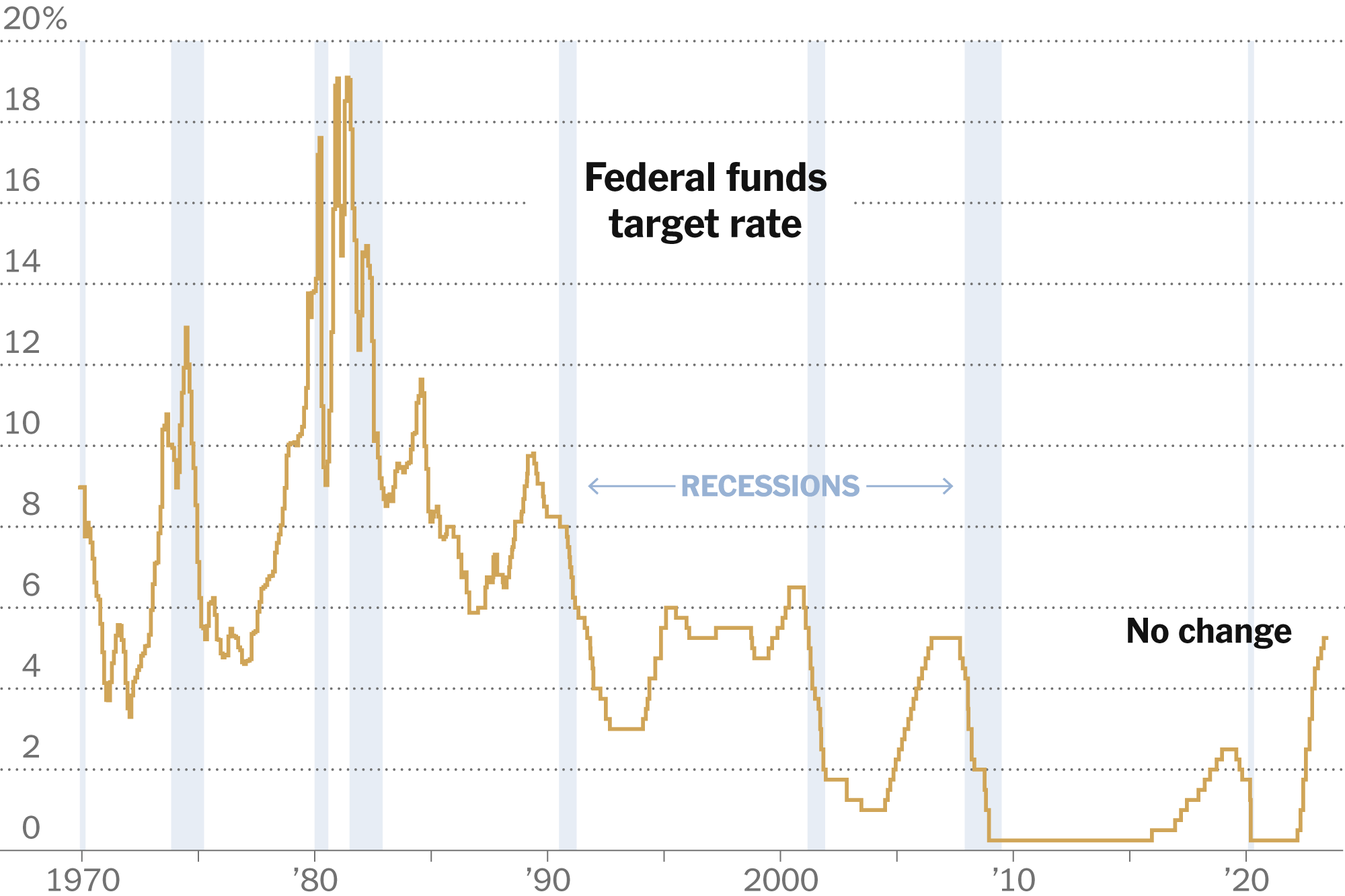

The Federal Reserve has concluded 2025 with a decisive yet controversial move, cutting its benchmark interest rate for the third consecutive time. The central bank’s Federal Open Market Committee lowered its key overnight borrowing rate by a quarter percentage point, putting it in a range between 3.5%-3.75%. This decision represents a significant shift in monetary policy as the Fed attempts to balance competing economic pressures whilst navigating an increasingly uncertain economic landscape.

The December rate cut was far from unanimous, highlighting deep divisions within the Federal Reserve. The Federal Open Market Committee voted to cut by 25 basis points with the support of nine policymakers with three dissenters. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid dissented in favour of leaving interest rates unchanged, while Fed Governor Stephen Miran dissented in favour of a larger 50-basis-point cut. This marked the highest number of dissents since 2019, underscoring the challenging economic conditions facing policymakers.

Economic Challenges Drive Policy Decisions

Policymakers said uncertainty remains elevated, with job gains slowing this year and the unemployment rate rising through September, while inflation has also risen over the course of the year and remains somewhat elevated. The Federal Reserve finds itself in a particularly difficult position, attempting to support a weakening labour market whilst managing inflation that continues to exceed its 2% target.

Adding to the complexity, important government data have been delayed due to the historic government shutdown that ended in mid-November after 43 days, forcing policymakers to make critical decisions with incomplete information. The unemployment rate rose slightly to 4.4 percent, and the core inflation rose to 2.8 percent according to the most recent data available from September.

Looking Ahead: Cautious Outlook for 2026

The Federal Reserve’s future path for interest rates appears increasingly restrictive. The closely watched “dot plot” of individual officials’ expectations on rates indicated just one cut in 2026 and another in 2027 before the federal funds rate hits a longer-run target around 3%. Fed Chair Jerome Powell emphasised the central bank’s comfortable position following the latest reduction, stating “We are well positioned to wait and see how the economy evolves”.

The market expects the Fed will hold interest rates steady at its next meeting in January, with a 75.6% probability of remaining at the 3.5% to 3.75% range, according to the CME FedWatch tool. This cautious approach reflects the Fed’s commitment to carefully assessing incoming economic data before making further adjustments to monetary policy.

Significance for British and Global Markets

The Federal Reserve’s decisions have far-reaching implications beyond American shores. Mortgage rates, which are indirectly impacted by Federal Reserve policy, are near the lowest levels of 2025. The average 30-year fixed mortgage rate was 6.19% last week. For UK investors and businesses with American exposure, these rate decisions influence currency valuations, investment returns, and global economic conditions. As the world’s most influential central bank adjusts its monetary policy stance, the ripple effects continue to shape financial markets worldwide, making understanding these decisions crucial for informed economic planning in 2026.