Latest Developments in LVMH Share Price

The Importance of Monitoring LVMH Share Price

The share price of LVMH Moët Hennessy Louis Vuitton, a leading luxury goods conglomerate, is crucial for investors and market analysts alike. As a symbol of luxury and affluence, LVMH plays a significant role in the global economy, and fluctuations in its share price can indicate broader trends in consumer spending, particularly in luxury markets.

Current Trends and Performance

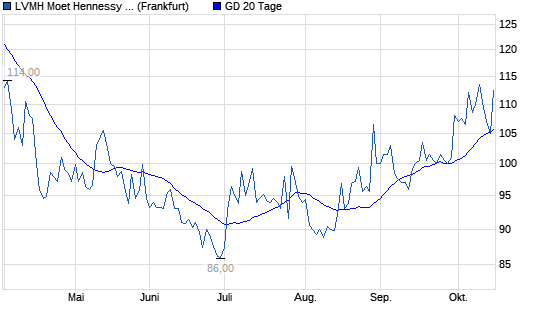

As of October 2023, LVMH’s share price has been experiencing notable fluctuations, largely influenced by changes in consumer behaviour and economic conditions. Following a robust recovery from the pandemic, LVMH reported impressive sales figures in the second quarter of 2023, with total revenues surging by 22% year-on-year to €25 billion. This growth was driven primarily by a resurgence in demand from Asia, particularly China, as consumers returned to shopping for luxury goods.

However, despite this growth, analysts have raised concerns regarding potential economic slowdown in key markets and inflationary pressures. Consequently, LVMH’s share price experienced a dip of approximately 5% last month, reflecting investors’ cautious sentiment. Key stock market analysts are closely monitoring these developments, as the luxury goods sector often serves as a barometer for overall economic health.

Factors Affecting LVMH Share Price

Several factors influence LVMH’s share price. Among them, international trade tensions, fluctuations in currency, and changes in consumer sentiment play critical roles. The ongoing uncertainty surrounding global economic conditions, coupled with inflation and rising costs of raw materials, could potentially impact LVMH’s profitability and, in turn, its stock performance.

Additionally, competition from emerging luxury brands and the digital transformation within retail have reshaped market dynamics. LVMH’s proactive strategies, including partnerships with tech companies and investments in e-commerce, aim to enhance its market position and sustain its competitive edge.

Conclusion: Future Outlook for LVMH Share Price

Looking ahead, analysts recommend investors remain vigilant regarding LVMH’s share price changes. While current trends appear robust, underlying economic factors present both opportunities and risks. In the luxury market, consumer sentiment will be pivotal. Should demand remain strong, LVMH is well-positioned to strengthen its market share further, though investors must be prepared for volatility in share price as broader economic conditions evolve.

In conclusion, LVMH’s share price is not just a reflection of the company’s performance, but also an indicator of wider economic trends, making it essential for investors to stay informed about the developments that could impact their financial decisions.