Latest Updates on UK State Pension Payments

Understanding the UK State Pension Payment System

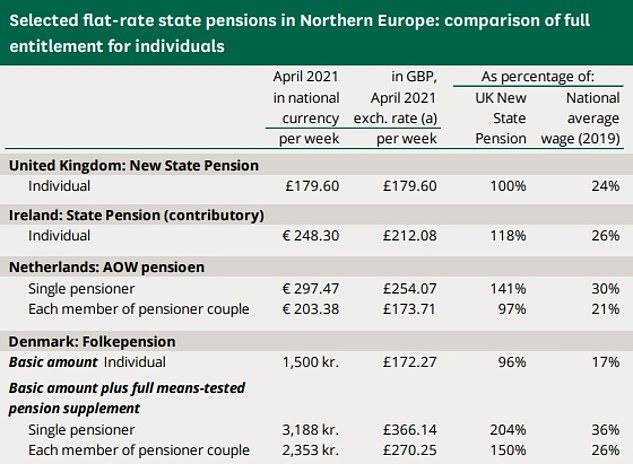

The UK State Pension is a crucial part of the social security system that provides financial support to individuals during retirement. With an ageing population and increasing life expectancy, the importance of understanding state pension payments has never been more relevant.

Current Payment Rates and Eligibility

As of April 2023, the full new State Pension is £203.85 per week for those reaching their State Pension age on or after 6 April 2016. For individuals who reached their State Pension age before this date, they may be entitled to the basic State Pension of up to £156.20 per week.

Changes to the System

The UK government has implemented changes to the state pension system to ensure its sustainability. These include a gradual increase in the State Pension age, which is currently set at 66 for both men and women, with plans to raise it to 67 by 2028. Furthermore, the government has announced that the pension would be indexed to inflation, earnings growth, or a flat rate increase, whichever is highest, ensuring that pensioners maintain their purchasing power.

Impact of Economic Factors

Inflation and economic factors have a significant impact on state pension payments. Recent rise in inflation rates has prompted the government to review pension increases. In 2022, the Triple Lock system was reinstated, ensuring that pensions rise in line with the highest of earnings, prices, or 2.5%, to protect pensioners from rising living costs.

Conclusion: What This Means for Retirees

For current and future retirees, understanding the nuances of the UK State Pension payment system is vital. As policies evolve and economic conditions change, it is crucial to stay informed about the eligibility and payment rates. It is advisable for individuals nearing retirement to regularly review their National Insurance contributions to ensure they qualify for the full State Pension. Be proactive in engaging with financial advisors to maximise retirement benefits and secure a comfortable future.