Lloyds Bank Share Price: A Remarkable Year and Optimistic Outlook for 2026

Introduction: Why Lloyds Bank Share Price Matters

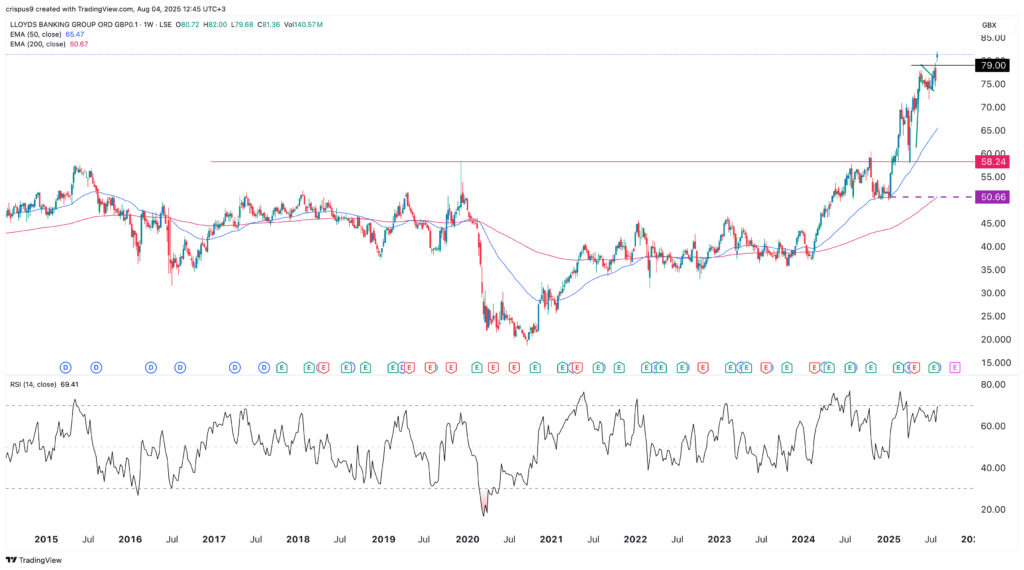

The Lloyds Bank share price has captured significant investor attention following an exceptional performance in 2025. Long-suffering Lloyds Banking Group investors had cause for cheer in 2025 as the share price soared nearly 80%, marking one of the strongest performances on the FTSE 100. As the UK’s largest mortgage lender and a major retail banking institution, Lloyds’ share price movements serve as a barometer for the health of Britain’s financial sector and wider economy. For investors seeking stable dividend yields combined with growth potential, understanding the dynamics behind Lloyds’ share price has become increasingly important.

Record Performance in 2025

Lloyds Banking Group has experienced a remarkable surge in share prices, climbing 76% since the beginning of the year, placing it ninth on the FTSE 100 leaderboard for 2025. As we reach the end of the year, the shares are hovering around the £1 mark, representing a significant milestone for the banking group. This impressive rally has outpaced even some high-profile technology stocks, demonstrating renewed confidence in traditional financial institutions.

The bank’s strong earnings performance has been a key driver of this success. In 2025, the bank exceeded expectations in its earnings reports, showcasing its capability to drive share price increases. Despite the substantial gains, Lloyds’ current valuation appears reasonable. Presently, the price-to-earnings (P/E) ratio stands at 15, with a forward P/E of 11, suggesting the share price growth is grounded in fundamentals rather than speculation.

Key Factors Influencing the Outlook

Several factors will influence Lloyds Bank share price in 2026. Interest rate decisions remain crucial, with the Bank of England’s meeting on February 5 is particularly significant, as decisions regarding interest rates directly impact bank profitability. Any further progress in 2026 could boost sentiment towards mortgage lenders — with Lloyds being the UK’s biggest.

Market analysts remain cautiously optimistic about the stock’s prospects. Out of 18 analysts, 11 rate Lloyds a Buy, even after the share price has had its best year for a long time. The bank also continues to attract income-focused investors, with Forward dividend & yield 0.03 (3.39%) offering attractive returns in the current market environment.

Conclusion: Significance for Investors

The Lloyds Bank share price story in 2025 demonstrates the potential for value creation in established financial institutions when economic conditions align favourably. For readers considering their investment options, Lloyds presents a compelling case study in how fundamental business performance can drive substantial returns. While replicating 2025’s extraordinary gains may prove challenging, the combination of reasonable valuation metrics, attractive dividend yields, and positive analyst sentiment suggests Lloyds remains relevant for both growth and income-focused portfolios. As the bank prepares to release its full-year results on 29 January 2026, investors will be watching closely to assess whether this momentum can continue into the new year.