Martin Lewis Issues Important Warning on Debit Card Safety

Introduction

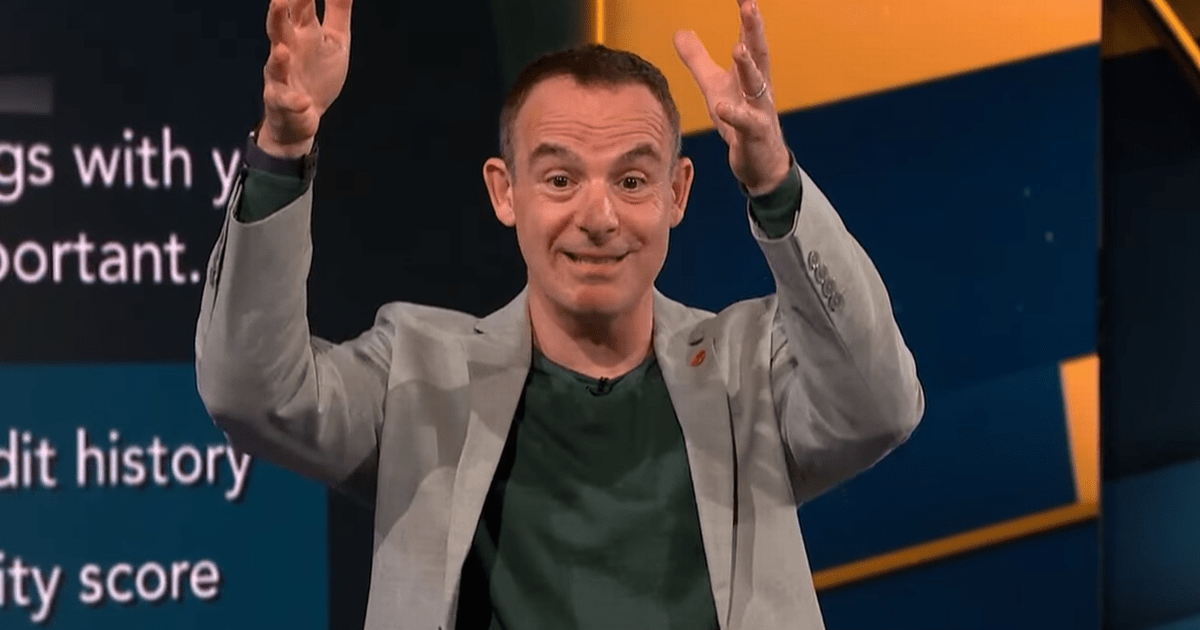

In a recent broadcast, financial expert Martin Lewis has issued a crucial warning regarding the use of debit cards. This topic is particularly relevant today as consumers increasingly rely on debit cards for daily transactions. With the rise of digital payments and online banking, understanding the risks associated with debit card usage has never been more important.

The Warning

Lewis highlighted potential dangers that come with using debit cards, particularly in the context of increased fraud and identity theft. He provided examples of sophisticated tactics being employed by criminals, such as skimming devices placed on ATMs and point-of-sale terminals that can capture card information.

According to recent statistics from the Financial Ombudsman Service, reports of debit card fraud have surged by over 30% in the last year alone. Lewis stressed that unlike credit card users, who have more protections and can dispute fraudulent charges, debit cardholders may find it more challenging to retrieve lost funds. This makes proactive measures essential.

Advising Consumers

During his segment, Martin Lewis advised consumers to closely monitor their bank statements for any suspicious activity and report any discrepancies immediately. He also recommended utilizing features such as transaction alerts available through many banking apps, which can help users stay informed about their spending.

Furthermore, he suggested that consumers consider virtual debit cards, which provide an extra layer of security for online purchases. These cards can reduce the risk of information being compromised, as they are not directly linked to a bank account and often have set spending limits.

Conclusion

Martin Lewis’s warnings serve as a vital reminder of the risks associated with debit card usage in an increasingly digital economy. As fraudsters devise new strategies to exploit unsuspecting consumers, it is imperative for individuals to take precautionary steps to safeguard their finances.

Looking ahead, it is anticipated that financial institutions will enhance their security measures to combat rising fraud rates. Consumers must remain vigilant and informed about their banking practices to ensure their hard-earned money is protected.