Nationwide Mortgage: Rate Cuts Bring Relief to UK Homebuyers in December 2025

Introduction: Why Nationwide Mortgage Rate Cuts Matter

In a significant development for UK homebuyers and homeowners, Nationwide has become the first major lender to announce mortgage rate cuts after the Bank of England lowered the base interest rate by 0.25% to 3.75% on 18 December 2025. This move is particularly important as Nationwide is the world’s largest building society, with over 16 million members and, following its acquisition of Virgin Money UK PLC, is connected with one in three people in the UK and is the second largest provider of mortgages and retail deposits. The rate reduction provides much-needed relief to borrowers navigating an expensive housing market.

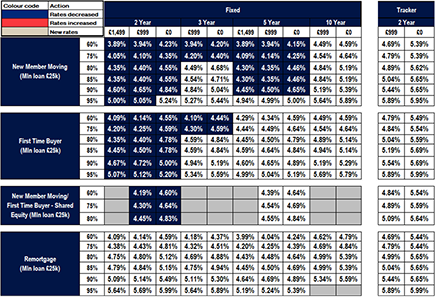

Latest Mortgage Rate Changes from Nationwide

Following the 0.25% decrease in the Bank Rate on Thursday 18 December, mortgage customers who are on Nationwide’s Standard Mortgage Rate (SMR) will see a decrease of 0.25%, with the new SMR of 6.49% coming into effect on 1 January 2026. Additionally, rates on tracker mortgages held by existing Nationwide customers automatically decrease when Bank Rate is cut, so these will decrease to reflect the Bank Rate change from 1 January 2026. Prior to this latest cut, the lender confirmed it would be slashing rates across its fixed rate mortgage range, with rates dropping by up to 0.21 percentage points across two, three and five-year products in early December.

Housing Market Resilience and Future Outlook

Robert Gardner, chief economist at Nationwide Building Society, described the housing market in 2025 as ‘resilient’, noting that even though consumer sentiment was relatively subdued, mortgage approvals remained near pre-Covid levels. Looking ahead, Nationwide expects a modest pick-up in market activity as affordability improves further, assuming income growth continues to outstrip house price growth and interest rates ease slightly. The annual rate of house price increase slowed from 4.7% at the end of 2024 to 2.1% by mid-2025 and then to 1.8% in November, indicating a cooling but stable market.

Conclusion: Significance for Homebuyers and Homeowners

The Nationwide mortgage rate cuts represent a positive shift for UK consumers struggling with housing affordability. With competitive rates now available and further modest interest rate decreases anticipated, prospective buyers and those looking to remortgage have an opportunity to secure more favourable deals. As the country’s largest building society adapts to the changing economic landscape, these adjustments could help thousands of members achieve homeownership or reduce their monthly mortgage payments. Borrowers are advised to review their options and consider switching deals to take advantage of the improved rates, particularly as tracker and standard variable rates continue to respond to Bank of England policy changes.