Navigating Pension Credit: What You Need to Know

Introduction

Pension Credit is an essential financial support scheme designed for older individuals in the UK. It aims to provide a minimum income guarantee to help pensioners who may be struggling to make ends meet. Understanding how Pension Credit works is increasingly vital as the cost of living rises, and many retirees seek ways to secure their financial futures.

What is Pension Credit?

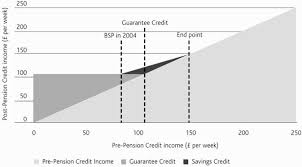

Pension Credit is a means-tested benefit available for those aged 66 and over. It consists of two parts: Guarantee Credit and Savings Credit. Guarantee Credit tops up a person’s weekly income to a standard minimum level, currently set at £177.10 for single claimants and £270.30 for couples. Savings Credit, on the other hand, is an additional benefit for those who have saved for retirement, with a maximum of £14.48 per week for single individuals and £16.20 for couples. However, Savings Credit is only available to those who reached the State Pension age before 6 April 2016.

Eligibility Criteria

To qualify for Pension Credit, individuals must be of State Pension age and resident in the UK, Channel Islands, or the Isle of Man. They must also have a weekly income below the threshold for Guarantee Credit. Furthermore, savings and investments are taken into account, but for most, the first £10,000 is disregarded. Individuals are encouraged to apply for Pension Credit, as it can also lead to additional benefits such as housing benefit and help with council tax.

Recent Changes and Government Support

In the wake of rising living costs, the UK government has been actively promoting Pension Credit to ensure vulnerable pensioners receive the support they need. Recent campaigns have highlighted that billions in unclaimed benefits are available, urging eligible individuals to come forward. The DWP (Department for Work and Pensions) aims to increase awareness and accessibility by simplifying the application process and providing support via online platforms and local community services.

Conclusion

Pension Credit serves as a crucial safety net for many in the UK as they navigate retirement. With ongoing efforts to raise awareness and increase applications, more older individuals can benefit from this financial assistance. It’s vital for pensioners and their families to stay informed about their eligibility and any changes to the programme, ensuring they maximise their available resources in a time of financial uncertainty. As the situation evolves, Pension Credit will likely remain a vital part of the support structure for older adults across the UK.