Rolls-Royce Share Price: Strong Start to 2026 Amid Strategic Growth

Rolls-Royce Share Price Performance

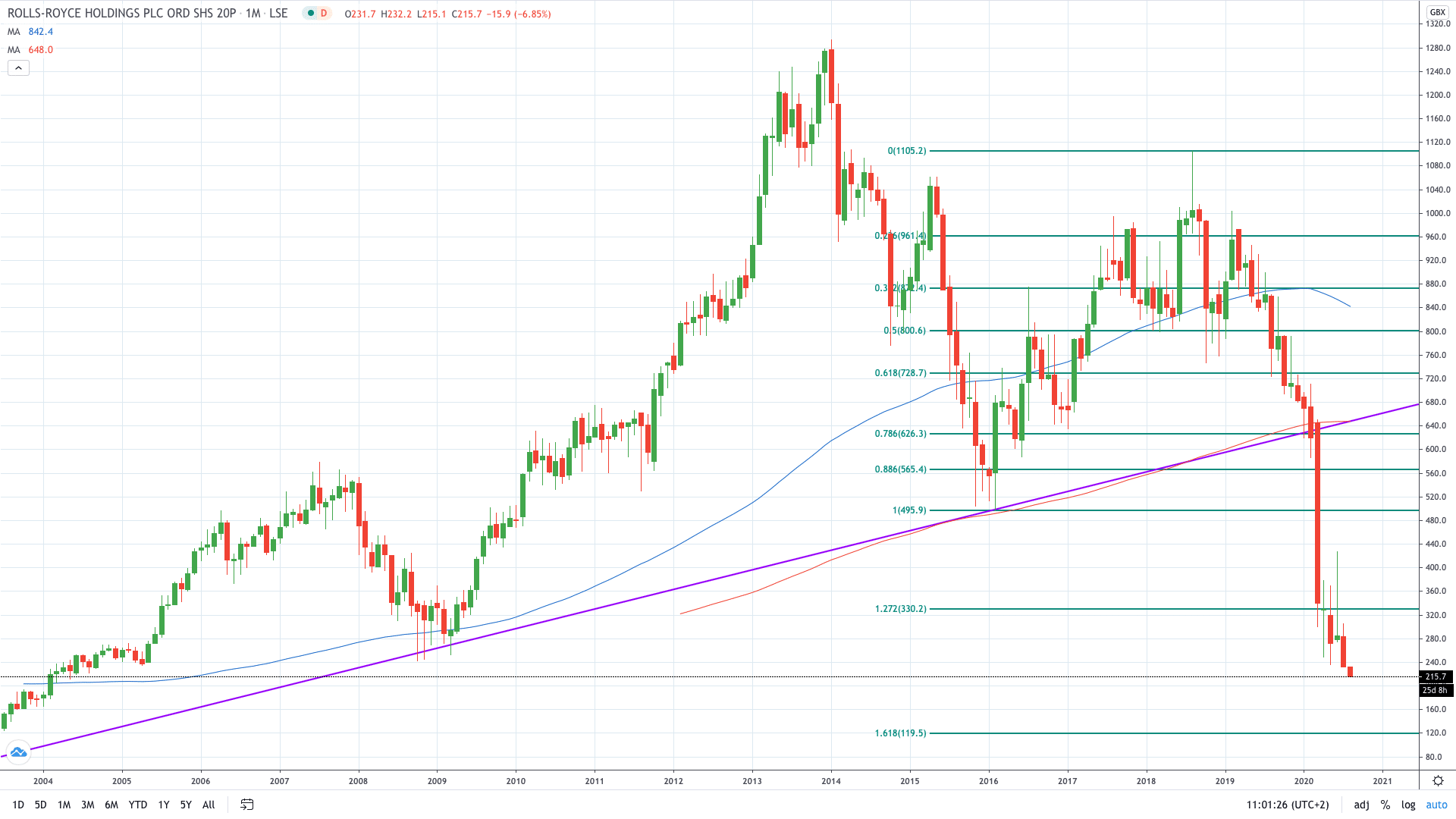

Rolls-Royce Holdings shares climbed 2.6% to 1,180 pence on the first trading day of 2026, continuing the company’s remarkable momentum. Rolls-Royce price changed by 96.45% in the past year, cementing its position as one of the FTSE 100’s standout performers. Over the last year, Rolls-Royce share price has been traded in a range of 638.00, hitting a high of 1,195.00, and a low of 557.00, demonstrating significant volatility alongside strong upward trajectory.

Financial Strength and Credit Rating

The company enters 2026 on solid financial footing. S&P Global Ratings has affirmed its long-term issuer credit rating of “BBB+” for the newly structured Rolls-Royce Holdings PLC, effective from January 1. This confirmation follows an upgrade to that level in August 2025, which S&P attributed to sustained profitability and growing cash generation. The agency’s outlook for 2026 anticipates a robust financial profile, including: A Free Operating Cash Flow (FOCF) of up to £3.3 billion, an adjusted EBITDA margin in the range of 18–19%, and a net debt-to-EBITDA ratio comfortably below 1.5x.

Share Buyback Programme

Rolls-Royce has initiated a new non-discretionary share buyback program valued at £200 million. This program follows the completion of a £1 billion buyback in November 2025. From a market perspective, such programs can provide technical support to the share price by reducing the number of freely tradable shares and introducing a consistent buyer in the market.

Growth Drivers and Defence Contracts

The company’s growth is underpinned by strong performance across multiple sectors. On 8 December 2025, Rolls‑Royce said it received a major order from KNDS to supply more than 300 mtu MB 873 engines for Leopard 2 battle tanks, with deliveries planned from 2026. Additionally, critical testing is underway in Indianapolis for the AE 1107F turboshaft engine. This powerplant is designated for the U.S. Army’s MV‑75 aircraft (formerly the V‑280 Valor), which was selected under the Future Long-Range Assault Aircraft (FLRAA) program to succeed the Black Hawk fleet.

Analyst Outlook and Investor Considerations

Right now 14 analysts have ratings on Rolls-Royce shares. The average 12-month price target among them is £12.64 per share, up 10% year on year. This reflects the company’s sky-high valuation following this year’s additional gains. Rolls Royce Holdings plc will release its next earnings report on Feb 26, 2026, a key date investors are watching closely. While the share price trajectory remains positive, the stock trades at around 37 times forward earnings currently – a very high value! This tends to mean the longer-term prospects are good and earnings growth is expected to rise, though valuations merit careful consideration for prospective investors.