Rolls-Royce Share Price Surges into 2026 with Strong Momentum

Introduction: A Remarkable Turnaround Story

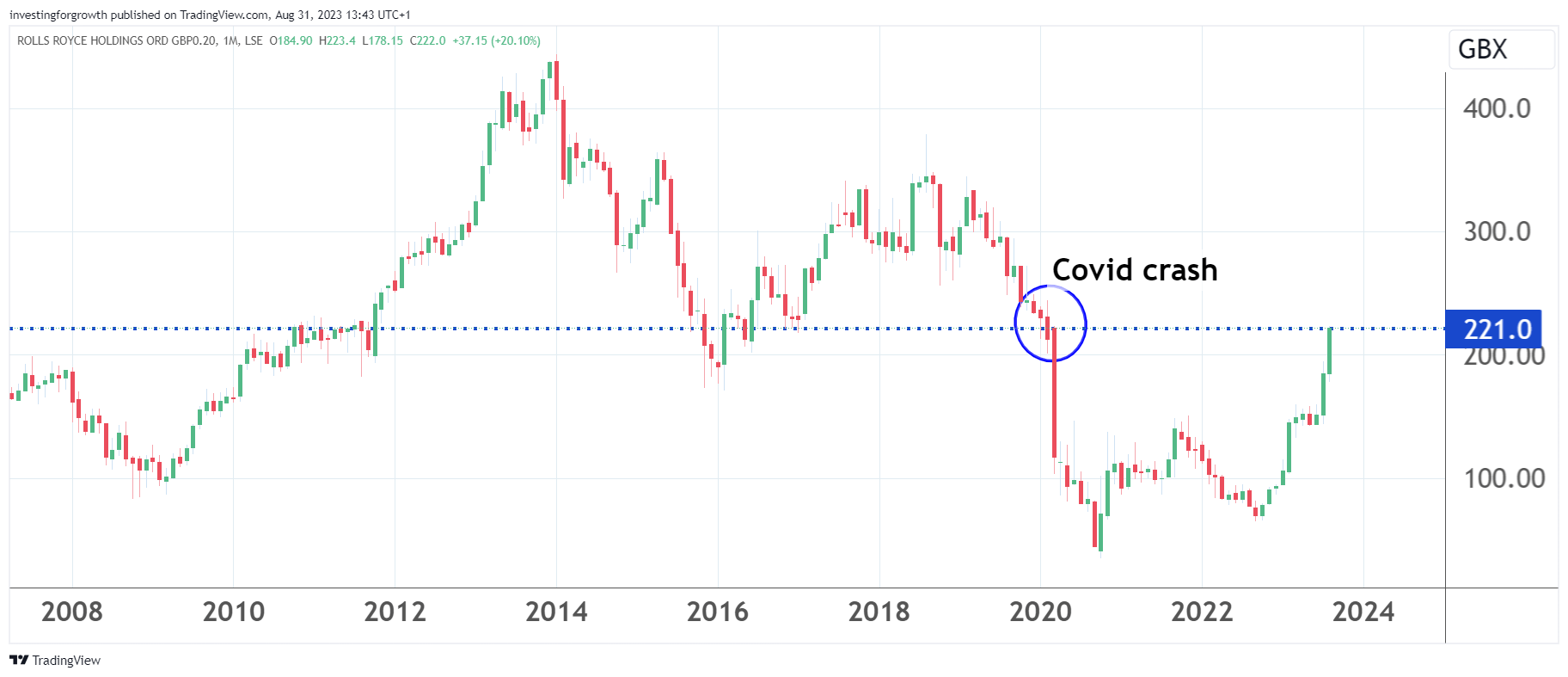

The Rolls-Royce share price has emerged as one of the most compelling stories on the London Stock Exchange, capturing investor attention as 2026 begins. Rolls-Royce share price (LON: RR) has begun 2026 with a new high, extending the gains achieved during a remarkable 2025. Rolls-Royce Holdings shares climbed 2.6% to 1,180 pence in early January trading, demonstrating continued confidence in the aerospace and defence giant’s strategic transformation. For investors seeking opportunities in UK industrials, understanding the factors driving this performance has become increasingly important.

Recent Share Price Performance and Market Position

The shares reached 1,197.50p, and continue to trade 3.7% higher at 1,192.50p into the close, as bulls look to continue the momentum into this year. This impressive trajectory builds upon an exceptional 2025, where Rolls-Royce shares nearly double, positioning the company as one of the top performers within the FTSE 100. The Rolls-Royce share price today is 1,188.7142p, reflecting a 3.34% change over the last 24 hours and 3.57% over the past week.

The company’s market capitalisation has swelled substantially, whilst Over the last year, Rolls-Royce share price has been traded in a range of 640.50, hitting a high of 1,197.50, and a low of 557.00.

Analyst Forecasts and 2026 Outlook

Market sentiment remains predominantly bullish. Of the 18 analysts currently covering the shares, 14 rate the stock a Buy or Strong Buy. Meanwhile, only four have it on Hold. None have the stock at Sell. Looking ahead, Consensus estimates point to net profit rising from £2.36bn in 2025 to £2.71bn in 2026, with earnings per share increasing from 28.2p to 32.6p. Dividends are also expected to grow meaningfully, from 9p to 11p per share.

Supporting this optimistic outlook, S&P Global Ratings has affirmed its long-term issuer credit rating of “BBB+” for the newly structured Rolls-Royce Holdings PLC, effective from January 1. This confirmation follows an upgrade to that level in August 2025, which S&P attributed to sustained profitability and growing cash generation.

Key Strategic Drivers

This upward trajectory reflects a range of factors, including upgraded financial forecasts, positive analyst sentiment, and strategic initiatives aimed at long-term growth. The company has demonstrated strong operational improvement, with a substantial 16% year-on-year increase in revenue, reaching £17.8 billion. Operating profit stood at £2.5 billion, exceeding market expectations and underscoring the effectiveness of the company’s turnaround strategy.

Additionally, Rolls-Royce has initiated a new non-discretionary share buyback program valued at £200 million. This program follows the completion of a £1 billion buyback in November 2025. The company has also secured significant defence contracts, including a major order from KNDS to supply more than 300 mtu MB 873 engines for Leopard 2 battle tanks, with deliveries planned from 2026.

Conclusion: Balancing Opportunity with Valuation Concerns

The Rolls-Royce share price story represents a remarkable corporate turnaround, driven by operational excellence, strategic diversification, and strong market fundamentals. However, investors should note that Rolls-Royce trades at around 40.8 times forward earnings, a level more commonly associated with high-growth technology stocks than industrials. Whilst the company’s prospects remain strong, particularly in civil aerospace and defence sectors, the current valuation suggests that much of the good news may already be reflected in the share price. For 2026, success will depend on continued execution and the ability to meet or exceed increasingly high market expectations.