The Importance of Savings for a Secure Financial Future

Introduction

Savings play a vital role in financial planning and stability, serving as a safety net during unexpected situations. With economic uncertainties and rising living costs, the relevance of savings has never been more pronounced. Understanding how to manage savings not only helps individuals and families prepare for emergencies but also enables them to achieve their long-term financial goals.

The Current State of Savings

According to the Bank of England, the household savings rate in the UK has fluctuated significantly in recent years, influenced by the pandemic and changing economic conditions. Recent statistics indicate that the average UK household saved approximately £3,000 in 2022, a figure lower than in previous years, reflecting the increasing financial pressures faced by many. These savings are essential not only for everyday expenses but also for larger investments such as buying a home or funding education.

Benefits of Saving

There are numerous benefits associated with having savings. Firstly, savings provide security and peace of mind. An emergency fund, typically covering three to six months of living expenses, can protect against unforeseen events like job loss or medical emergencies. Secondly, savings can also facilitate investment opportunities, allowing individuals to make significant purchases or investments such as property or retirement funds. According to a recent survey by Lloyds Bank, those with savings expressed higher levels of overall financial well-being compared to those without.

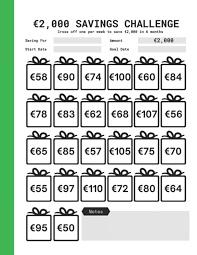

Strategies for Effective Saving

Implementing effective saving strategies can lead to substantial improvements in financial health. Experts recommend setting clear savings goals, whether short-term or long-term, to maintain motivation. Utilizing high-interest savings accounts, creating a budget to monitor expenditures, and automating savings contributions can also enhance the saving process. Moreover, it is advised to review and adjust savings plans monthly to ensure alignment with changing financial circumstances.

Conclusion

The significance of savings cannot be overstated. They form the foundation of financial resilience and empower individuals to navigate life’s unpredictabilities while striving towards personal ambitions. As we face increasing economic challenges, prioritising savings is essential for both immediate needs and long-term financial stability. Moving forward, the focus on cultivating a robust savings plan will become increasingly important for achieving financial peace of mind.