The Importance of Savings in Today’s Economy

Introduction

Savings play a fundamental role in personal finance, acting as a safety net for unforeseen circumstances and providing a pathway to achieving financial goals. In a world increasingly characterized by economic uncertainty, understanding the importance of savings is paramount for individuals and families alike. This article explores the significance of savings, current trends, and practical strategies to enhance financial security amidst ongoing economic changes.

Current Trends in Savings

Recent studies have shown a notable increase in savings rates across the UK. According to the Office for National Statistics (ONS), the household saving ratio saw a significant rise during the pandemic, peaking at 29.1% in Q2 2020. Although this figure has since stabilised, it highlights a growing awareness of the need for financial resilience. As people faced job losses and uncertainty, many realised that having an emergency fund could mean the difference between stability and crisis.

Reasons for Saving

There are several compelling reasons for individuals to prioritise savings:

- Emergency Fund: Financial experts recommend setting aside three to six months’ worth of living expenses to cover unexpected costs such as medical emergencies or job loss.

- Major Purchases: Savings allow individuals to make significant purchases, such as homes or vehicles, without incurring high-interest debt.

- Retirement Planning: Saving for retirement ensures financial independence in later years, with pensions and savings accounts playing crucial roles.

- Investment Opportunities: Savings can be invested for future growth, aiding in wealth accumulation over time.

Strategies for Effective Saving

For those looking to improve their savings habits, here are some practical strategies:

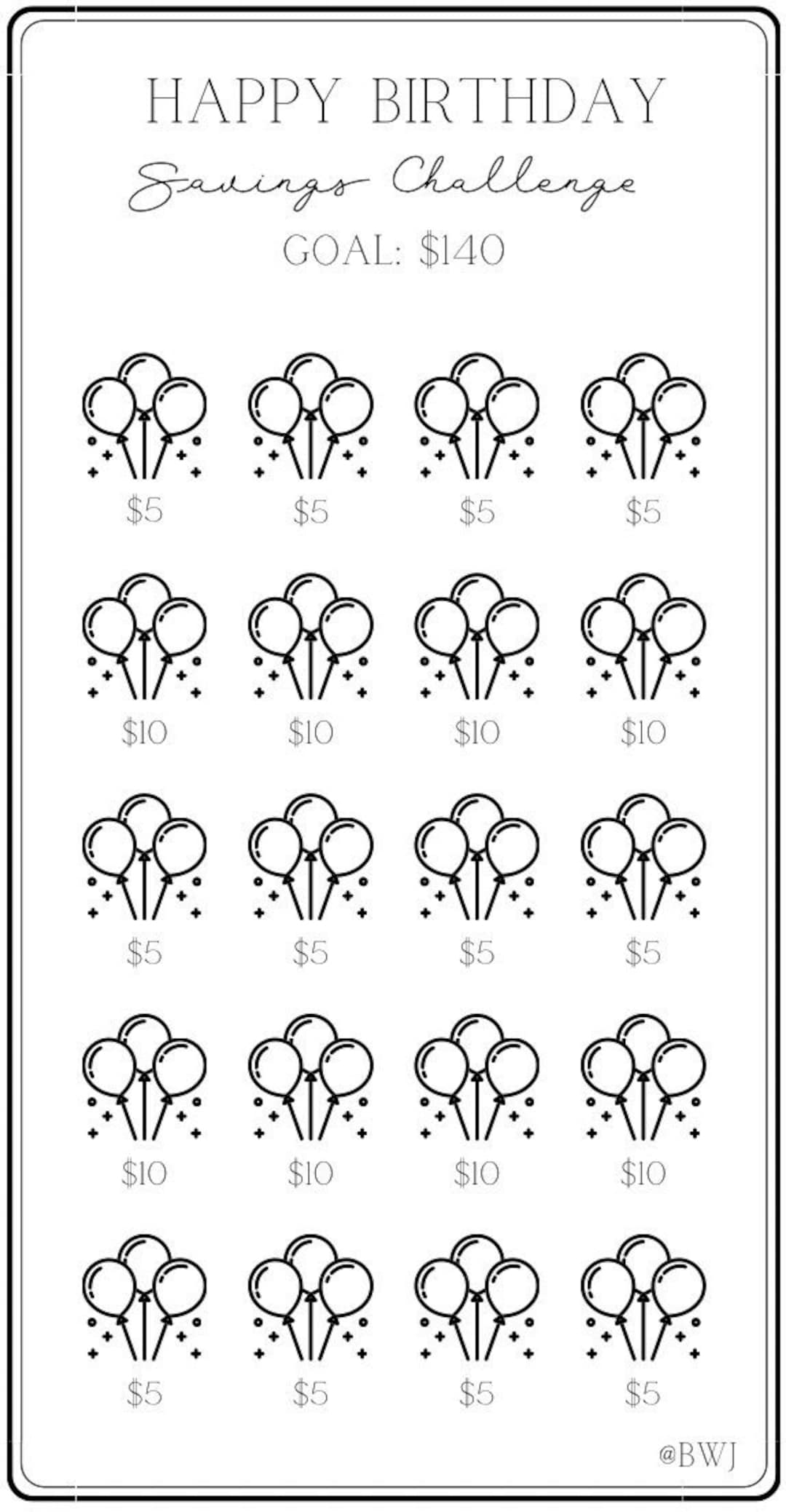

- Set Clear Goals: Determine short-term and long-term savings goals to stay motivated.

- Create a Budget: Tracking income and expenses can help identify areas to cut back and allocate more to savings.

- Automate Savings: Setting up automatic transfers to savings accounts can help build a habit and ensure consistent contributions.

- Take Advantage of High-Interest Accounts: Utilize accounts that offer better interest rates to maximise savings.

Conclusion

In summary, savings are not just a financial buffer; they are integral to building a secure financial future. With rising costs and economic fluctuations, understanding the importance of savings can empower individuals to take control of their financial health. As we move forward, cultivating good saving habits will become increasingly essential for navigating the complexities of modern life. Emphasising the need to save can promote financial literacy and well-being for individuals and families in the UK.