The Role of Experian in Credit Reporting

Understanding Experian’s Importance

Experian is one of the largest credit reporting agencies globally, playing a critical role in the financial landscape by providing credit scores and reports to consumers and businesses alike. With the increasing reliance on credit in today’s economy, understanding how Experian operates and its implications for consumers has never been more relevant.

The Services Offered by Experian

Founded in 1996, Experian provides a range of services that go beyond traditional credit reporting. It offers credit monitoring, identity theft protection, and even consulting services for businesses looking to make informed lending decisions. According to recent statistics, around 1.2 billion people are connected with Experian’s vast consumer database, showcasing its widespread influence.

Recent Developments

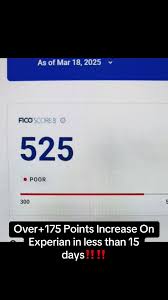

In recent months, Experian has rolled out numerous initiatives aimed at enhancing consumer financial literacy. They launched a new mobile app that assists users in understanding their credit scores and provides personalised tips on improving their credit health. Additionally, Experian has expanded its partnerships with financial institutions to ensure that more consumers have access to their credit reports, especially in underrepresented communities.

Privacy Concerns

With the power held by credit reporting agencies like Experian, concerns over privacy and data security continue to grow. In 2022, Experian faced scrutiny after a data breach exposed sensitive consumer information. The company responded by increasing its security measures and investing in data protection technology to safeguard consumer privacy going forward.

Conclusion: The Future of Experian

As credit plays a major role in economic stability, the importance of agencies like Experian is clear. Looking ahead, it is likely that Experian will continue to adapt and innovate, ensuring that consumers maintain awareness and control over their credit health. As more people seek financial advice, Experian’s role in helping them make informed decisions will only become more significant in shaping financial futures.