Understanding Bitcoin USD: Current Trends and Insights

Introduction to Bitcoin and USD

Bitcoin, the pioneering cryptocurrency, has garnered significant attention since its inception in 2009. Its value, expressed in USD, remains a critical barometer for investor sentiment and market trends within the broader cryptocurrency ecosystem. The ongoing fluctuations in Bitcoin’s USD value are not merely numbers; they represent evolving investor confidence, regulatory developments, and technological advancements within the blockchain sector.

Recent Developments in Bitcoin USD Value

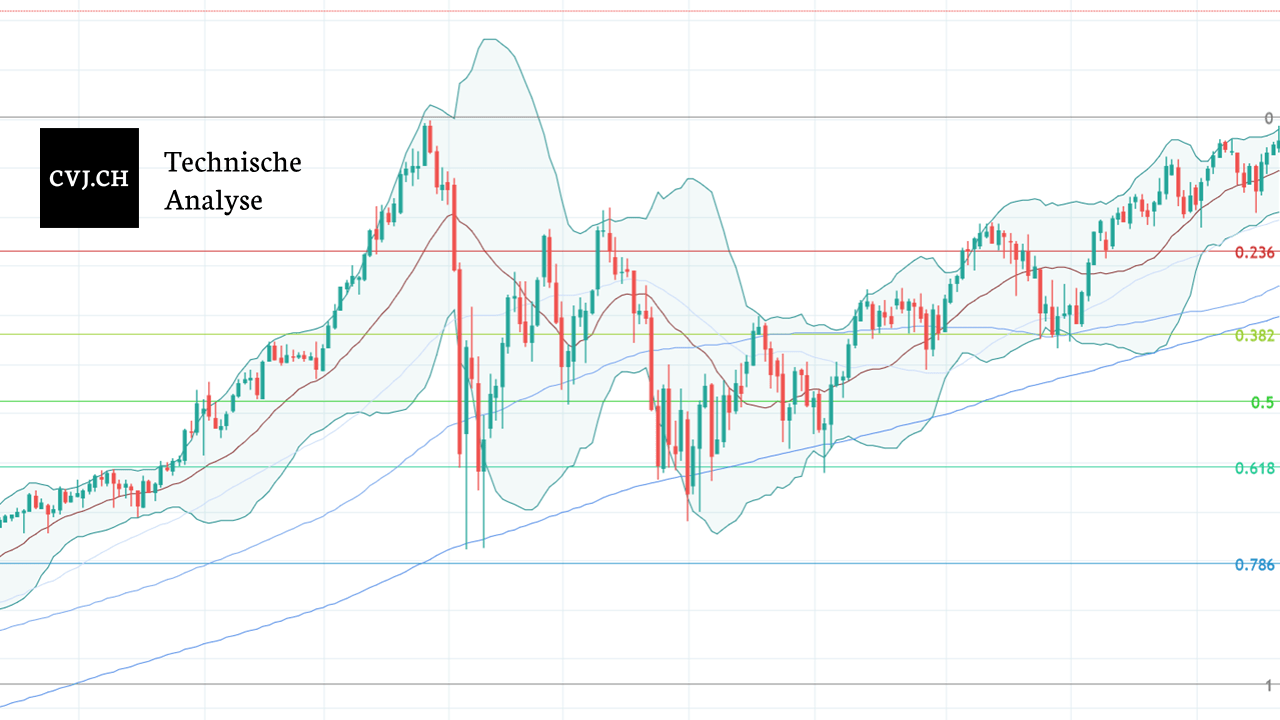

As of October 2023, Bitcoin has seen considerable volatility against the US dollar. Following a recent surge that brought the price to approximately $45,000 per Bitcoin, analysts are closely observing market conditions. This recent rise can be attributed to various factors, including increased institutional investment, the launch of Bitcoin ETFs, and growing mainstream acceptance of digital currencies. Market analysts note that the correlation between Bitcoin’s price and macroeconomic factors — such as inflation rates and interest rates — has become increasingly significant.

In addition, geopolitical uncertainties and the potential for new regulations in major markets like the United States and Europe continue to play roles in price fluctuations. A report from CoinMarketCap indicates that Bitcoin’s dominance in the cryptocurrency market has slightly increased, standing at around 45%, illustrating its continued relevance amidst a sea of alternative coins.

Implications for Investors

For both seasoned investors and those new to cryptocurrency, understanding the Bitcoin USD value is essential for making informed investment decisions. Market analysts suggest that potential investors should pay close attention to trends and news that could signal impending changes in Bitcoin’s price. The overall sentiment around Bitcoin often acts as an indicator of the cryptocurrency market’s health, and significant price dips can lead to broader concerns regarding investor confidence.

Conclusion and Future Trends

In conclusion, Bitcoin’s value in USD is not only a reflection of supply and demand but also a microscopic view of the future directions of the entire financial landscape. The ongoing developments in regulatory frameworks, technological innovations, and market dynamics indicate that Bitcoin will continue to be a focal point for investors. As we move towards the end of 2023 and into 2024, analysts suggest that Bitcoin could see further volatility, yet its role as a digital asset will likely strengthen, driven by both retail and institutional demand. Staying informed about Bitcoin’s performance against USD will be crucial for anyone engaged in or contemplating entry into the cryptocurrency sphere.