Understanding Klarna: A New Era in Online Shopping

Introduction

The rise of e-commerce has drastically changed how consumers approach shopping, and Klarna is at the forefront of this revolution. Established in Sweden in 2005, Klarna has evolved into one of the world’s leading payment service providers, facilitating a smoother and more flexible shopping experience while driving greater sales for retailers. As consumers increasingly demand convenience and adaptability, Klarna’s services—ranging from ‘buy now, pay later’ (BNPL) options to seamless payment solutions—have gained significant traction and relevance in today’s market.

What is Klarna?

Klarna offers a convenient payment platform that enhances the online shopping experience by allowing customers to shop and pay in a way that suits them best. With options to pay immediately, within 14 or 30 days, or through monthly instalments, Klarna caters to diverse financial preferences and situations. The company collaborates with over 250,000 retailers globally, including major brands like H&M, Adidas, and eBay, making it a versatile choice for shoppers.

Recent Developments

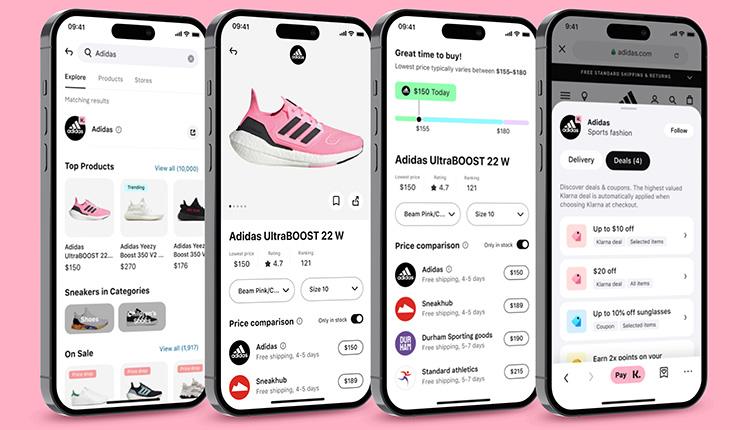

In recent months, Klarna has expanded its services to include additional features such as the Klarna app, which allows users to track spending, find deals, and manage payments all in one place. The app has quickly attracted millions of users, leading to a boost in the company’s valuation, which recently topped £6 billion. Furthermore, Klarna is now working on integrating more advanced artificial intelligence technologies to better predict consumer behaviour and tailor its offerings accordingly.

Consumer Impact

Klarna’s services have sparked a debate about their implications for consumer behaviour, especially regarding the potential for overspending. Critics argue that BNPL schemes may encourage consumers to purchase more than they can afford, leading to financial strain. However, proponents highlight that Klarna provides an accessible means for budgeting, allowing those with irregular incomes to manage expenses more effectively.

Conclusion

As the landscape of consumer payments continues to evolve, Klarna’s influence is undeniable. The company not only enhances the online shopping experience but also promotes financial flexibility in an increasingly digital world. Looking ahead, it will be crucial for consumers to approach BNPL options responsibly to harness the benefits while mitigating risks. Klarna is likely to remain a prominent player in redefining shopping habits, ultimately shaping the future of retail.