Understanding Rolls Royce Share Price Trends

The Significance of Rolls Royce Share Price

The Rolls Royce share price is a crucial indicator of the company’s financial health and investor sentiment. As a leading manufacturer of aircraft engines and power systems, fluctuations in the Rolls Royce stock can significantly affect investor decisions, market analysts, and the broader aerospace industry. The company’s performance is closely tied to global aviation trends, making the share price an important measure for both institutional and retail investors.

Current Market Analysis

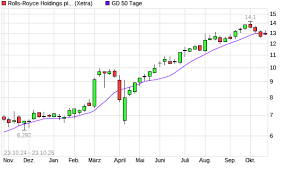

As of October 2023, Rolls Royce share price has seen considerable volatility, influenced by several key factors. The company has recently made headlines due to increased demand for new aircraft engines as airlines ramp up operations post-COVID-19 pandemic. However, challenges such as supply chain disruptions and rising material costs have also impacted the company’s profitability. In September 2023, Rolls Royce reported a 15% increase in its interim revenue, leading to a surge in its share price, which climbed to £1.30 by early October.

Recent Developments

Moreover, Rolls Royce has initiated several strategic moves to enhance its market position. The company is investing heavily in sustainable aviation technology, aiming to achieve net-zero carbon emissions by 2050. This green initiative has resonated well with investors, driving interest in the stock as environmental concerns become more prominent in investment decisions. On the other hand, analysts have expressed caution regarding the potential risks associated with the global geopolitical situation and its effect on the energy markets, which could indirectly influence Rolls Royce’s operations.

Looking Ahead

Looking forward, analysts predict that the Rolls Royce share price will continue to be dictated by the recovery of the global aviation sector and the effectiveness of its innovations in sustainable technology. If the demand for aircraft remains strong and the company successfully navigates the challenges it faces, there could be a positive outlook for its share price over the next financial year. However, investors are advised to monitor not only the economic indicators but also the ongoing trends in the aerospace industry to make informed decisions.

Conclusion

In conclusion, the Rolls Royce share price remains a key subject of interest in the investment community. With a cautiously optimistic outlook for the future, it is imperative for investors to stay updated on the company’s performance and market trends. As the aviation industry continues to recover and adapt, the movements of Rolls Royce’s stock will likely reflect broader economic conditions and technological advancements.