Understanding State Pension Retirement Age Changes in the UK

Introduction

The state pension retirement age in the UK has been a subject of considerable debate and concern in recent years. As the population ages and life expectancy increases, adjustments to the retirement age have become necessary. Understanding these changes is crucial for future retirees planning their financial futures.

Current State Pension Retirement Age

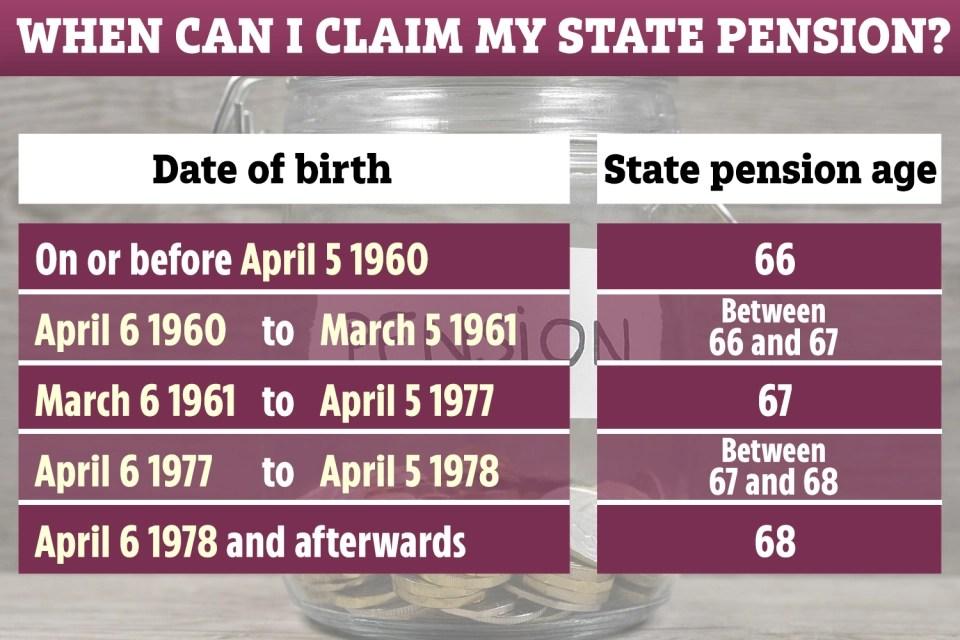

As of October 2023, the state pension retirement age is gradually increasing for both men and women. Currently, the pension age stands at 66 for both genders, and it is set to rise to 67 by 2028. Recent legislative changes indicate plans for a further increase to age 68, potentially by the mid-2030s, as outlined in the 2017 Review of the State Pension Age.

Government Rationale

The UK Government cites increasing life expectancy as a primary reason for these changes. According to the Office for National Statistics, the average life expectancy has risen significantly, which places greater financial pressure on the pension system. Therefore, extending the working age is intended to ensure the sustainability of state pension funds.

Public Reaction and Concerns

The adjustments to the retirement age have sparked a variety of reactions. Many future retirees express concern over the feasibility of working longer, particularly in physically demanding jobs. Recent surveys indicate that a significant number of individuals believe that the planned increases are unfair, especially to those nearing retirement age. Advocacy groups argue that the changes disproportionately affect those in lower socio-economic groups who may not be able to work longer due to health or job conditions.

Future Developments

Looking ahead, further reviews of the state pension retirement age are expected. The Department for Work and Pensions (DWP) is likely to conduct further assessments based on demographic, health, and economic factors. Stakeholders will be watching closely, as adjustments could impact planning for millions of current and future pensioners.

Conclusion

The state pension retirement age is a critical topic that affects the financial planning and wellbeing of many individuals in the UK. As the retirement age evolves, it is essential for citizens to stay informed and prepare accordingly. With ongoing discussions regarding further increases, the government must balance financial sustainability with the needs and capabilities of its workforce. It is recommended that individuals begin to engage in proactive planning as these changes unfold, ensuring they are prepared for retirement, regardless of the age at which they can claim their state pension.