Understanding Stocks and Shares ISA Tax Benefits: Your Complete Guide for 2025/26

Why Stocks and Shares ISA Tax Benefits Matter

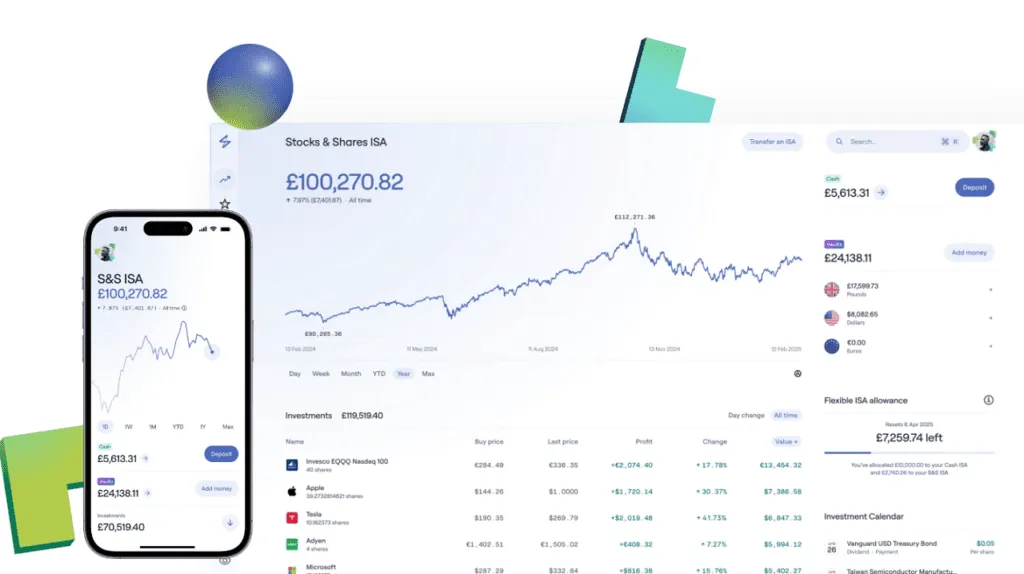

As the 2025/26 tax year progresses, understanding the tax advantages of Stocks and Shares Individual Savings Accounts (ISAs) has never been more important for UK investors. The annual ISA allowance stands at £20,000 for the 2025/26 tax year, offering significant opportunities for tax-efficient wealth building. With dividend allowances outside ISAs limited to just £500 for the current tax year and capital gains tax allowances reduced to £3,000, the tax shelter provided by ISAs has become increasingly valuable for investors.

The Three Key Tax Advantages

Stocks and Shares ISAs mean you don’t pay dividend, capital gains or income tax on any gains or income from investments held within them. This triple tax benefit represents substantial savings for investors. First, all dividend income inside your Stocks and Shares ISA remains tax free, compared to paying rates between 8.75% and 39.35% outside an ISA depending on your tax bracket. Second, any gains on investments within your Stocks and Shares ISA are not subject to Capital Gains Tax, protecting profits when you sell appreciated assets. Third, all interest earned from interest-bearing investments in your Stocks and Shares ISA is not liable to income tax, benefiting those holding corporate bonds and gilts.

Making the Most of Your ISA Allowance

The £20,000 allowance for 2025/26 doesn’t roll over – if you don’t use it, you lose it forever, making it crucial to invest before the 5 April deadline. You can use all or part of this ISA allowance to invest in funds, bonds, and shares in individual companies. The flexibility extends beyond the current year: it’s possible to have substantial amounts invested within ISAs, with over £200,000 accumulated since ISAs began in 1999. Financial experts recommend using Stocks and Shares ISAs for long-term goals, as most experts recommend using them for investments lasting five years or more.

Conclusion: A Powerful Tool for Tax-Efficient Investing

For UK investors, Stocks and Shares ISAs represent one of the most powerful tax-efficient investment vehicles available. With reduced tax allowances outside ISAs and inflation concerns, protecting investment returns from taxation has become increasingly important. Whether you’re building wealth for retirement, saving for major purchases, or simply seeking to maximise investment returns, understanding and utilising your annual ISA allowance can make a significant difference to your long-term financial outcomes. As tax rules continue to evolve, the protected status of ISA investments remains a cornerstone of smart financial planning for UK residents.