Understanding the DWP State Pension Increase 2025

Introduction

The Department for Work and Pensions (DWP) is set to implement a significant increase in the state pension for the year 2025. This adjustment is crucial for millions of retirees in the United Kingdom, as it directly impacts their financial stability and overall living standards. Understanding the expected changes can help individuals better prepare for their financial future.

The Importance of the DWP State Pension

The state pension represents a primary source of income for many older adults in the UK. It is designed to provide financial support during retirement, and adjustments to its value are closely monitored by society and economics experts alike. The upcoming increase in 2025 aims to reflect rising living costs and economic conditions faced by citizens.

Details of the Increase

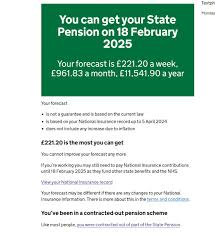

As of now, the DWP has not disclosed the exact percentage increase for the state pension in 2025. However, it is anticipated to be linked to the triple lock system, which guarantees that state pensions rise by either inflation, average wage growth, or 2.5%, whichever is highest. Current inflation rates and wage growth trends suggest a substantial rise is possible, particularly in light of the economic disruptions caused by the COVID-19 pandemic.

Impact on Retirees

For retirees, an increase in the state pension can mean enhanced financial security. The additional income may allow individuals to cover increasing living expenses such as heating, healthcare, and daily essentials. Financial analysts predict that this increase will play a crucial role in helping to alleviate the burden of inflation that many pensioners are currently experiencing.

Conclusion and Future Implications

While the exact figures for the DWP state pension increase in 2025 are yet to be officially announced, the expectations highlight the government’s commitment to support its ageing population. As the date approaches, retirees are encouraged to keep informed and plan accordingly. The significance of this increase cannot be overstated as it serves as a vital pillar for many in their retirement years. Continued advocacy for sustainable pension policies will be essential to ensure that future generations are also protected.