Understanding the Hang Seng Index: Trends and Significance

Introduction to the Hang Seng Index

The Hang Seng Index (HSI) is a benchmark index for the Hong Kong stock market, representing the performance of the largest and most liquid stocks traded on the Hong Kong Stock Exchange (HKEX). As one of the most important indicators of Hong Kong’s financial health, the HSI significantly influences both regional and global markets. In recent times, the Hang Seng Index has seen fluctuating performance, reflecting various economic and geopolitical events, making it essential for investors and analysts to monitor its movements.

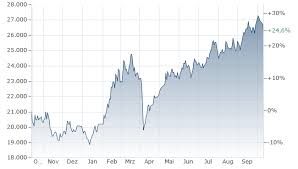

Recent Trends in the Hang Seng Index

As of October 2023, the Hang Seng Index has experienced notable fluctuations driven by several factors. After reaching a low in early 2023, the index has shown signs of recovery, notably rising by around 15% over the past few months as investor sentiment improved. This rebound is attributed to stabilising economic conditions, easing regulatory pressures in China, and renewed interest in technology stocks, which constitute a significant portion of the index.

Moreover, the index faced headwinds from external factors, including rising US interest rates and ongoing geopolitical tensions in the Asia-Pacific region, which have kept some investors cautious. Despite these challenges, analysts are optimistic about the Hang Seng Index’s potential for further growth, with projections suggesting a possible upward trend as investors seek opportunities in the region.

Significance of the Hang Seng Index

The Hang Seng Index serves as a critical barometer for market sentiment in Asia, particularly for investors looking to gain exposure to Chinese and Hong Kong enterprises. It includes major contributors such as Tencent, HSBC, and AIA Group, which play essential roles in not only the local economy but also globally. As one of the key indexes in Asia, the HSI is regularly monitored by investors, analysts, and economic policymakers.

Conclusion

In summary, the Hang Seng Index remains a vital financial indicator for the Hong Kong market and the broader Asian economy. Given the recent trends indicating a potential recovery amidst global uncertainty, stakeholders should keep a close eye on its movements. Future developments in China’s economy and central bank policies will likely impact the index’s direction. As always, investors are encouraged to conduct thorough research and consider the broader economic landscape when making investment decisions related to the HSI.