Understanding the Recent Trends in Tesla Share Price

Introduction

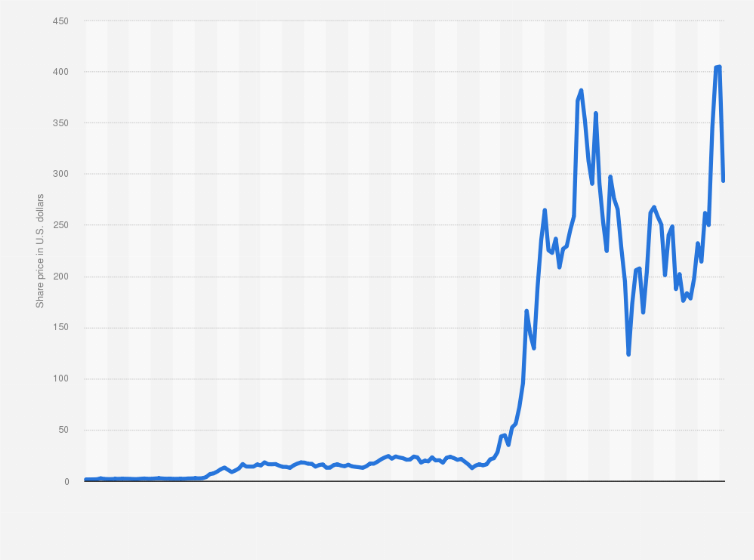

The Tesla share price has been a focal point for investors and market analysts alike, reflecting the company’s volatile yet progressive trajectory in the automotive and energy sectors. As a key player in the electric vehicle market, fluctuations in Tesla’s share price not only signify broader market trends but also indicate investor sentiment towards innovative technologies.

Recent Developments

As of October 2023, Tesla shares have shown significant fluctuations influenced by various factors including quarterly financial reports, production updates, and shifts in market demand for electric vehicles. The company recently announced a record delivery number for the third quarter, which somewhat buoyed the stock price. This event underlines the ongoing demand for Tesla’s vehicles and their increasing market penetration.

Additionally, Tesla’s strategic expansions, including the opening of new Gigafactories and partnerships with renewable energy companies, have also contributed positively to investor confidence. In contrast, concerns regarding competition from other electric vehicle manufacturers and regulatory changes in major markets like China and Europe have created uncertainty, leading to price volatility.

Market Analysis

Market analysts paint a mixed picture regarding the future performance of Tesla shares. While some analysts forecast bullish trends due to innovations in battery technology and continued growth in their energy division, others caution against potential downturns stemming from rising interest rates and increased operational costs. According to the latest reports, analysts suggest a range of target prices from £180 to £300, underscoring the uncertainty enveloping the stock.

Conclusion

In conclusion, the Tesla share price remains a key indicator of not only the company’s performance but also the overall health of the green technology industry. Investors are advised to closely monitor quarterly earnings, production goals, and market developments as they navigate the complex currents of the stock market. The potential for future growth remains significant; however, the competitive landscape and external economic factors may pose challenges ahead. Understanding these dynamics is crucial for making informed investment decisions in relation to Tesla shares.