Understanding the State Pension in the UK: Updates and Future Prospects

Introduction

The state pension is a crucial financial safety net for millions of retirees in the UK, providing essential income support after a lifetime of work. As the population ages and life expectancy increases, understanding the current state pension system and its future developments becomes imperative for both current and future retirees. Recent announcements regarding changes in pension age and payment rates have significant implications for those planning for retirement.

Current State Pension Rates and Eligibility

As of 2023, the new state pension is set at £203.85 per week for those qualifying under the new regime, which applies to individuals who reached State Pension age on or after 6 April 2016. The basic state pension for older retirees is £156.20 per week. Eligibility for the full amount generally requires a minimum of 35 qualifying years of National Insurance contributions. Recent reports indicate that approximately 12.5 million people in the UK receive state pensions, making it a significant component of retirement income.

Recent Changes to State Pension Policy

The government’s recent budget announcements have indicated an expected rise in the state pension as part of the annual review. According to the ‘triple lock’ policy, which guarantees that pensions will rise by the highest of inflation, average wage growth, or 2.5%, beneficiaries are set to see a rise in their payouts. However, fluctuations in inflation rates, which recently peaked at over 10%, have prompted widespread debates about the sustainability of this policy.

Future Implications for State Pension System

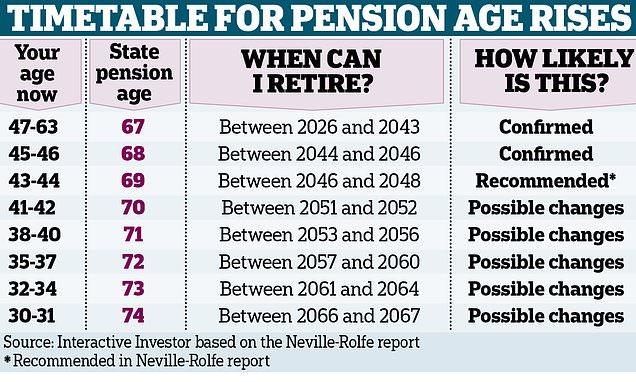

With life expectancy continuing to rise, the sustainability of the state pension system is under scrutiny. The government is considering a phased increase in the state pension age, currently pegged at 66, which is expected to rise to 67 by 2028. Additionally, consultations are under way regarding potential reforms that could impact future rates and eligibility. Economic analysts predict that any future changes will significantly influence retirement planning, requiring individuals to adapt their financial strategies accordingly.

Conclusion

In conclusion, the state pension remains a vital support system for retirees across the UK, but it faces numerous challenges in the coming years. The interplay between economic factors, demographic changes, and government policy will shape the future landscape of pensions. As such, it is essential for individuals approaching retirement, as well as current pensioners, to stay informed about these developments and consider their financial planning in light of potential changes. Understanding the state pension system’s dynamics will play a crucial role in ensuring a secure retirement income.