Understanding the Triple Lock State Pension Increase

The Importance of the Triple Lock

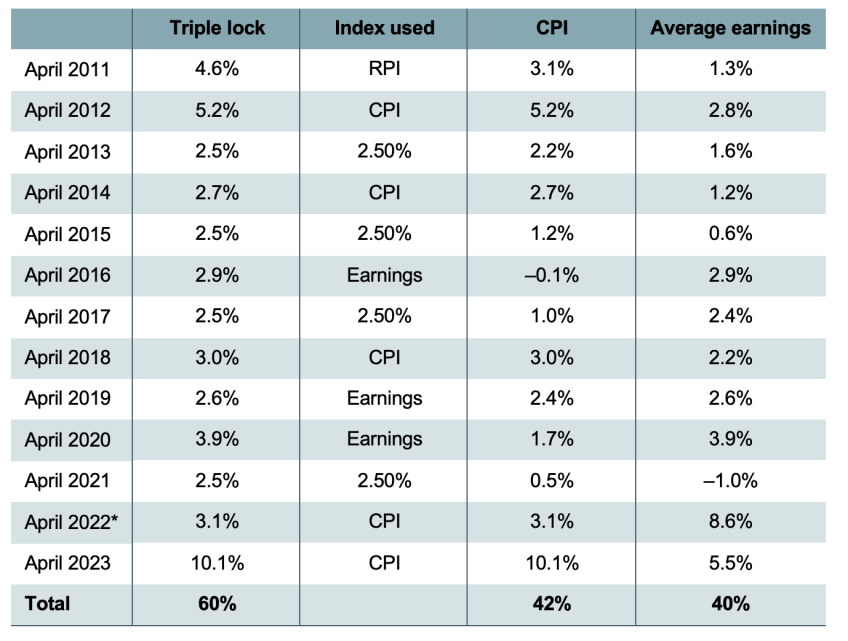

The triple lock mechanism offers essential protection for state pensions in the UK, ensuring that they keep pace with inflation, average earnings, or a minimum increase of 2.5%, whichever is the highest. Introduced in 2010, it aims to provide financial security for retirees amidst rising living costs and economic uncertainty.

Current Increase Announced

As of October 2023, the UK Government has confirmed a significant increase in the state pension rate following the triple lock criteria. For the financial year commencing April 2024, the state pension is set to rise by 8.5%. This increase correlates directly with the most recent Consumer Price Index (CPI) inflation rate, which was published at 6.2% for the year, alongside the growth in average earnings of 7%.

Impact on Retirees

This increase in the state pension payments is expected to substantially benefit millions of retirees, particularly those on fixed incomes who may struggle with rising costs of living. For example, a full new state pension will rise from £203.85 to approximately £221.79 per week from April 2024, providing a lifeline for many aged individuals and ensuring that their purchasing power is not undermined.

Political Reactions

The announcement has generally been welcomed by various political groups and advocacy organisations representing the elderly, who argue that the triple lock is vital for upholding the financial welfare of retired citizens. However, there are discussions about the sustainability of such increases in light of the government’s fiscal policies and economic challenges. Some critics highlight that while the rise is necessary, it may place additional strain on the state pension budget in the long term.

Conclusion and Future Implications

In conclusion, the projected triple lock state pension increase represents a critical development for retirees across the UK, bolstering their financial stability against inflation and economic changes. As the cost of living continues to fluctuate, the relevance of the triple lock remains a topic of discussion in terms of its future viability. Policymakers are urged to consider the balance between providing adequate support for retirees and maintaining a sustainable economic model. For readers, staying informed on these developments is essential, as they can directly impact personal financial planning and the welfare of families reliant on state pensions.