Understanding Today’s Gold Price Trends

The Importance of Gold Prices

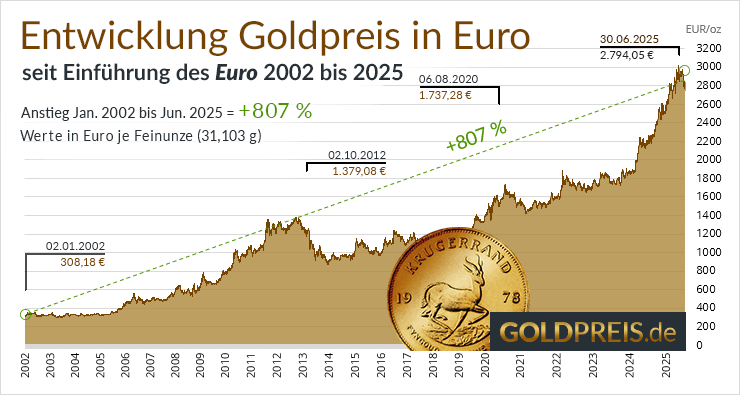

Gold has long been considered a safe-haven asset and an important indicator of economic stability. As investors face uncertainties in global markets, understanding the fluctuations in gold prices becomes crucial. With inflationary pressures, geopolitical tensions, and central bank policies all influencing the price of gold, keeping abreast of its movements is essential for investors and the general public alike.

Current Trends in Gold Prices

As of October 2023, gold prices have seen significant volatility. Recent market analyses indicate that gold is trading at around £1,500 per ounce, a level not witnessed since earlier this year. The rise in prices can be attributed to several key factors:

- Inflation Concerns: As inflation rates climb in various economies, investors are flocking to gold as a hedge against currency devaluation.

- Geopolitical Tensions: Escalating tensions in Eastern Europe and the Middle East have led to increased uncertainty, driving demand for safe-haven assets like gold.

- Central Bank Policies: With the Bank of England and other central banks keeping interest rates low, the opportunity cost of holding gold diminishes, leading to higher demand.

Future Predictions for Gold Prices

Experts predict that gold prices may remain elevated as long as inflation continues to outpace wage growth and geopolitical tensions linger. Some analysts forecast that gold could reach up to £1,600 per ounce by the end of the year if current trends persist. Additionally, the upcoming monetary policy decisions by central banks will play a critical role in shaping the price movements of gold.

Conclusion

In conclusion, the fluctuations in gold prices reflect broader economic and geopolitical realities. Investors should stay informed about market conditions and potential policy changes that could impact gold prices. For those interested in investing in gold, understanding these dynamics will be vital in making informed decisions. As we move towards the final quarter of 2023, keeping an eye on gold trends will be more important than ever.