A Comprehensive Overview of the State Pension

Introduction

The State Pension is a crucial component of the United Kingdom’s social security system, providing financial support to retired individuals who have contributed to the National Insurance scheme. With growing concerns about an ageing population and economic sustainability, understanding the State Pension’s changes and its implications on the future is more relevant than ever.

Current Structure and Eligibility

The State Pension system consists primarily of the Basic State Pension and the New State Pension, introduced in April 2016. To qualify, individuals must have at least ten qualifying years on their National Insurance contributions. Currently, the full New State Pension stands at £203.85 per week, while the Basic State Pension is £141.85 per week for those who reached state pension age before April 2016. This amount is subject to review and typically increases each year in line with inflation or wage growth.

Recent Changes and Economic Context

As of 2023, the UK government is facing debates regarding eligibility and the pension age. Initially set at 66, the state pension age is scheduled to increase to 67 between 2026 and 2028. This move is part of a broader strategy to ensure long-term viability of the pension system amid rising life expectancy and dwindling contributions from the working population.

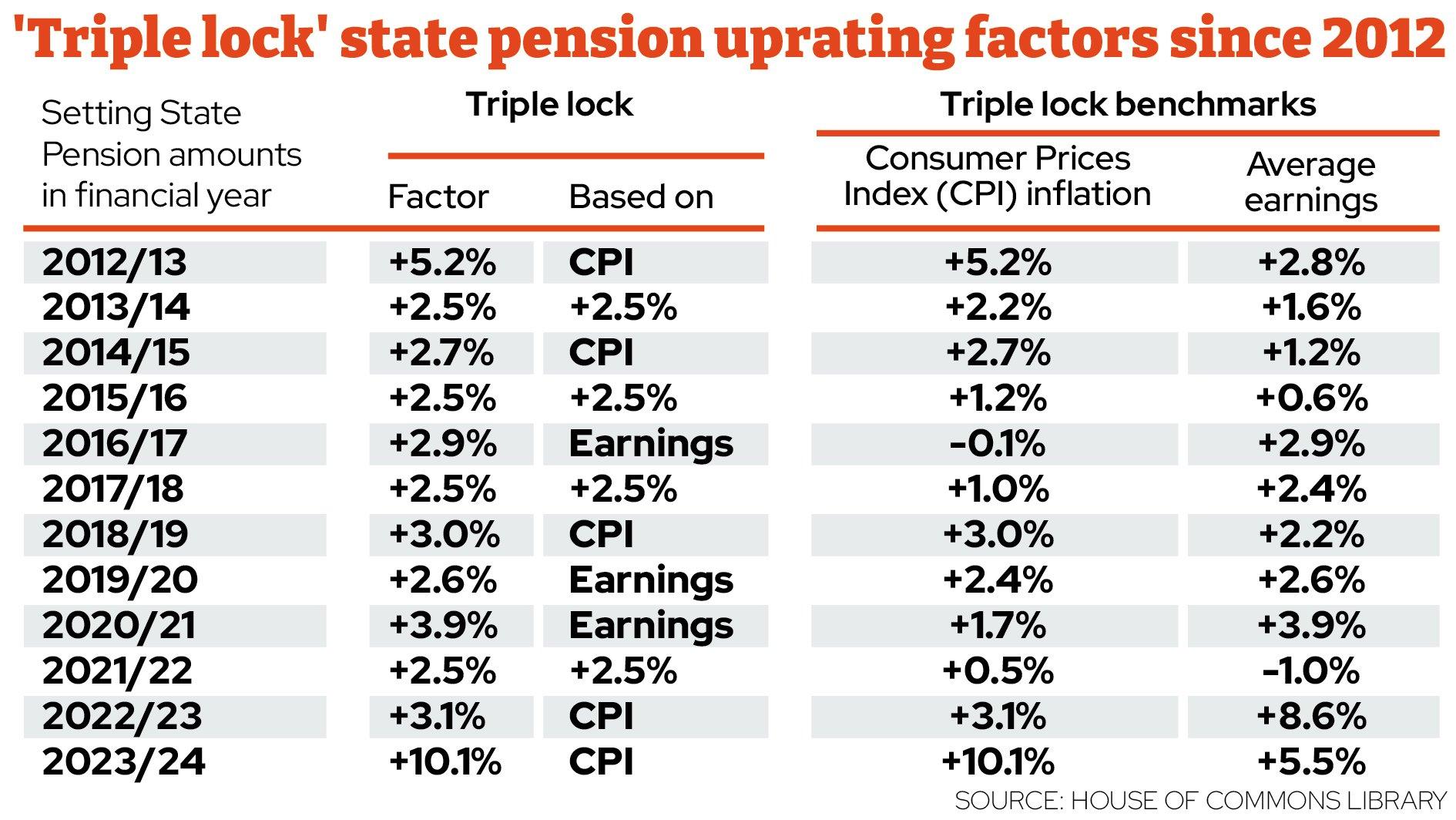

In addition, recent economic challenges, including inflation and the cost-of-living crisis, have placed significant pressure on pensioners. The 2022 decision to raise the State Pension by 3.1% was met with mixed reactions, with many arguing that it was insufficient to counteract the rising costs of essentials.

Future Implications

Looking ahead, the State Pension will be key in determining the financial stability of millions of retirees in the UK. Analysts suggest that ongoing adjustments to the pension age and payment rates will be necessary to address demographic shifts. Some experts advocate for a more granular reform that might include additional support for lower-income pensioners.

Conclusion

In conclusion, the State Pension remains a vital part of the UK’s welfare framework. As economic conditions evolve, it is crucial for both current workers and future retirees to stay informed about potential changes to the program. With discussions around pension reforms ongoing, the implications for how much, when, and how people will receive their pensions are of paramount importance and will shape the future of retirement in the UK.