Everything You Need to Know About Council Tax in the UK

Introduction to Council Tax

Council tax is a local taxation system in England, Scotland, and Wales. Introduced in 1993, it has become a crucial source of funding for local councils, enabling them to provide services such as education, emergency services, and public transport. This tax is based on the value of residential properties and aims to ensure that those who benefit from local services contribute to their funding.

How Council Tax is Calculated

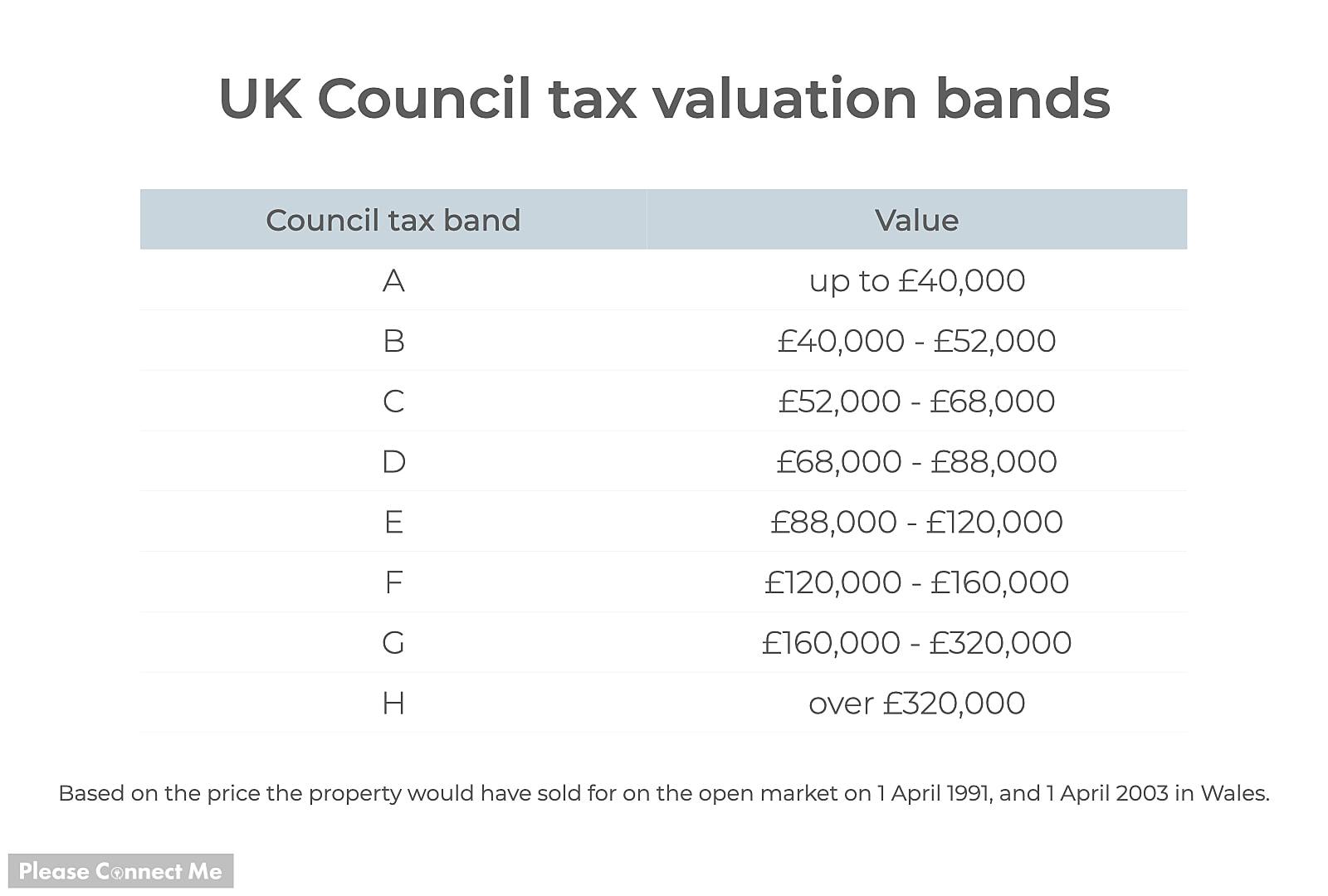

Council tax is assessed based on property values, categorised into bands from A to H, with Band A properties being the least expensive and Band H being the most expensive. The banding of a property is determined by its estimated value on a specific date (April 1, 1991, in England and April 1, 2003, in Wales). Each local council sets its own council tax rates for each band, which can lead to significant variations across different areas. Additionally, discounts are available for specific groups, including students, the elderly, and those living alone, which can significantly reduce the tax burden.

2023 Updates in Council Tax Policy

In 2023, many local councils have proposed increases to council tax rates to cope with escalating costs and budget shortfalls. The average increase across England was reported at about 4%, aiming to address inflation and rising service costs. Furthermore, changes in government policy have allowed councils to raise taxes without holding local referendums, sparking debates about transparency and community consent. Local authorities argue that these hikes are necessary to maintain essential services amidst financial pressures.

Impacts of Council Tax on Residents

The implementation of council tax has direct implications for residents, affecting their monthly budgets. The rising tax rates have raised concerns over affordability, especially for low-income households. Critics argue that the current tax structure is regressive, disproportionately affecting those with lower incomes. In recent discussions, calls have emerged for a reform of the council tax system, suggesting a more progressive tax approach based on income levels rather than property value.

Conclusion

As council tax continues to be a significant topic of discussion across the UK, its implications for funding local services and the financial burden on residents remain critical. The current debates surrounding council tax increases and the potential for reform reflect broader issues of economic inequality and governmental accountability. Residents are encouraged to stay informed about local council decisions and contribute their voices to discussions regarding the future of council tax in their communities.