Scottish Budget 2026-27: Major Tax Changes and Record NHS Investment Revealed

Scotland Unveils Landmark Budget for 2026-27

The Scottish Budget sets out the Scottish Government’s proposed spending and tax plans for 2026-27, as presented to the Scottish Parliament. Finance Secretary Shona Robison delivered her final budget on 14th January 2026 before stepping down ahead of May’s Holyrood election, introducing investments totalling almost £68 billion in this year alone. This significant financial package aims to support families facing cost-of-living pressures whilst strengthening Scotland’s public services and economy.

Income Tax Changes Benefit Lower Earners

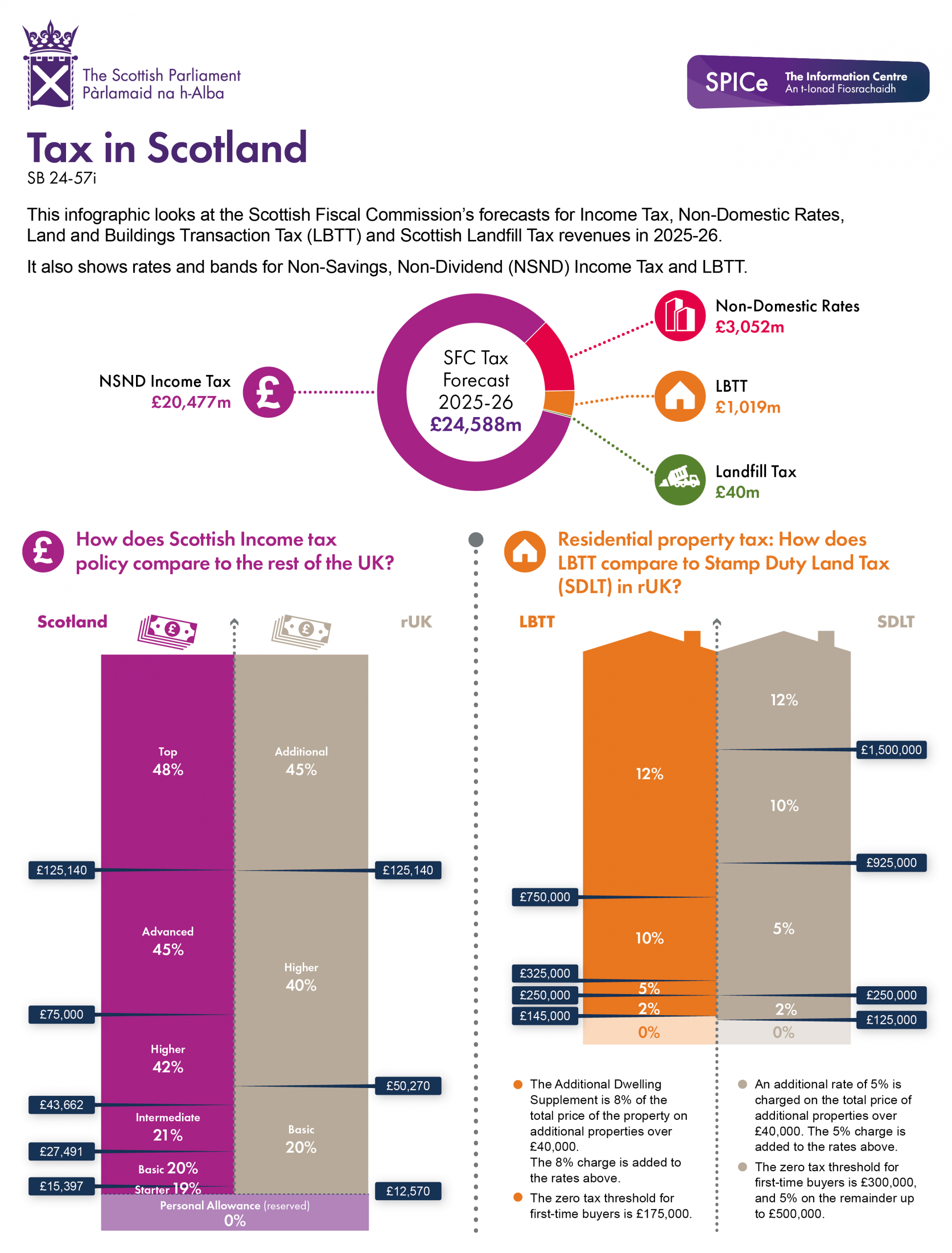

One of the budget’s most notable features is its approach to income tax reform. In 2026-27, if the Budget is passed, the Basic and Intermediate rate thresholds will increase by 7.4% to £16,537 and £29,526 respectively, whilst the Higher, Advanced and Top rate thresholds will remain at £43,662, £75,000 and £125,140 respectively. This means taxpayers earning less than £33,500 will pay less income tax in Scotland than they would in the rest of the UK, with the government estimating that around 55-57% of Scottish taxpayers will benefit from lower tax rates compared to elsewhere in the United Kingdom.

Record NHS Investment and Family Support

Healthcare receives unprecedented attention in this budget, with a record £22.5 billion for health and social care. The Scottish Child Payment, a flagship anti-poverty initiative, will increase to £28.20 a week per child from April 2026, in line with inflation. More significantly, from 2027, the rate will rise to £40 for families with children under the age of one, providing substantial additional support for families during the crucial first year of a child’s life.

New Council Tax Bands and Environmental Investment

Looking ahead, properties valued between £1m and £2m will fall into a new Band I, while homes worth more than £2m will be placed in Band J, with these changes taking effect from April 2028. Fewer than 1% of households are expected to be affected by these new council tax bands. Environmental commitments remain robust, with funding for nature restoration in Scotland this year triple what is was two years ago.

Looking Ahead: Challenges and Opportunities

Whilst the budget aims to deliver comprehensive support, it faces significant constraints. Relative to plans laid out in June, the Finance Secretary has had to cut day-to-day spending by £480 million, largely due to much weaker underlying tax forecasts from the Scottish Fiscal Commission. As Scotland’s parliament debates these proposals, support from other parties will be needed for the Budget to pass, since the SNP lacks a majority at Holyrood. The budget represents a careful balancing act between supporting families, investing in public services, and maintaining fiscal sustainability during challenging economic times.