Understanding the Current State Pension Age in the UK

Introduction

The state pension age (SPA) is a crucial aspect of the UK retirement system, determining when individuals can begin receiving their state pension benefits. As life expectancy rises and demographic changes occur, the government continually reviews and adjusts the SPA. Understanding these changes is essential for current and future retirees, impacting financial planning and lifestyle choices.

Current State Pension Age

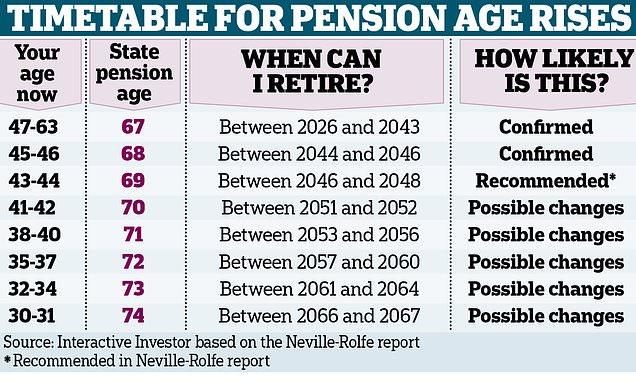

As of October 2023, the state pension age in the UK stands at 66 years for both men and women. However, the government plans to increase the SPA to 67 years between 2026 and 2028, followed by a proposed increase to 68 years around 2044. These adjustments are part of a broader strategy aimed at ensuring the long-term sustainability of the pension system amid an ageing population.

Impact of State Pension Age Changes

The decision to raise the state pension age has sparked considerable debate. Supporters argue that it is necessary due to increased life expectancy and the need to maintain a viable pension fund. Critics believe that such changes disproportionately affect those in physically demanding jobs or with poor health, who may not have the means to work longer.

The recent changes have encouraged discussions surrounding retirement planning. Many individuals are now reassessing their savings and investments to prepare for a delayed retirement. Additionally, employers are adjusting workforce strategies to retain older workers while providing opportunities for younger generations.

Government Review and Future Considerations

The UK government intends to conduct reviews every few years to consider future state pension ages in relation to public health trends and financial sustainability. The next review is anticipated to unveil changes based on demographic data and economic conditions, allowing policymakers to make informed decisions regarding future pension age adjustments.

Conclusion

Managing expectations regarding the state pension age is crucial for effective retirement planning. As changes are implemented, individuals must stay informed and adapt their financial strategies accordingly. The proposed increases in the state pension age underscore the importance of proactive retirement planning and highlight the challenges associated with ageing populations. As new information emerges, it will remain vital for individuals to review their retirement plans regularly to ensure financial security in their later years.